Knometa Research, which took over the semiconductor production capacity research business from the discontinued IC Insights, announced that by the end of 2023, the semiconductor production capacity by country/region (products produced in that country/region with installed semiconductors), factory location (regardless of headquarters location), and future forecasts will be announced.

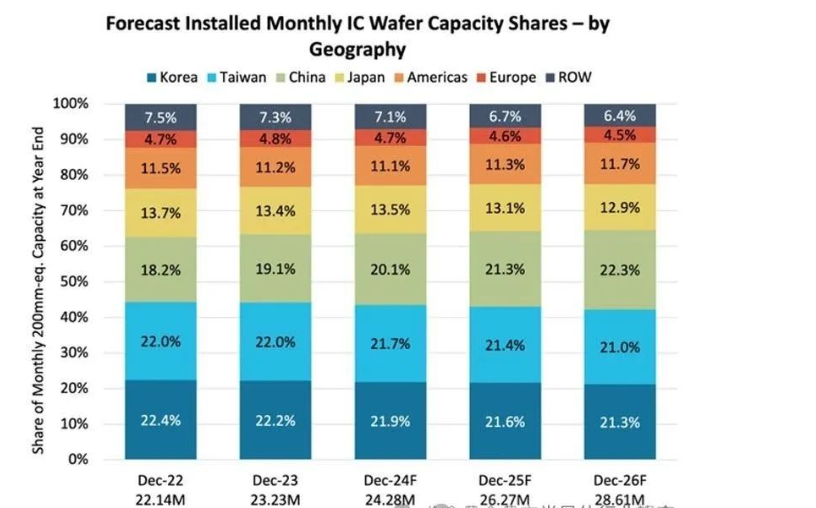

The report shows that by the end of 2023, the production capacity accounted for 22.2% in South Korea, 22.0% in Taiwan, China, 19.1% in Chinese Mainland, 13.4% in Japan, 11.2% in the United States and 4.8% in Europe. Looking ahead, it is expected that China's share will gradually increase and may become the largest share by country/region by 2026. On the other hand, Japan's share is expected to decrease from 13.4% in 2023 to 12.9% in 2026.

Since the COVID-19 pandemic, the construction of new wafer fabs around the world has rapidly increased. This is because many countries are providing subsidies to attract semiconductor manufacturing to their own countries to address supply chain issues exposed during the pandemic, and this measure is likely to continue. The Knometa report predicts that by 2026, the wafer production capacity of IC wafer fabs will grow at an average annual rate of 7.1%, with relatively slow growth in 2024. However, new production capacity is expected to increase significantly in 2025 and 2026.

Every semiconductor production area around the world is building new factories. China is no exception, with semiconductor regulations centered around the United States attempting to restrict Chinese companies from developing and introducing cutting-edge processes. However, China will continue to increase wafer production capacity in the coming years, with a focus on traditional processes. It is estimated that by 2026, Chinese Mainland will have the world's largest IC wafer production capacity, surpassing South Korea and Taiwan, China.

Most foreign companies with wafer fabs in China, including Samsung Electronics, SK Hynix, TSMC, and UMC, have received partial relaxation of China's semiconductor regulations. By the end of 2023, a significant portion of China's IC wafer production capacity will come from these large foreign companies, as well as foreign companies including Powerchip Semiconductor Manufacturing (through its Chinese Nexchip subsidiary), Texas Instruments, Alpha&Omega Semiconductor, and Dior. China accounts for approximately 19% of global wafer production, with only 11% owned by Chinese companies.

At present, such Chinese companies are also increasing their production capacity. Knometa predicts that by 2025, China's production capacity share will be almost equal to that of major countries, and by 2026, China will rank first.

*Disclaimer: The content of the article is the author's personal opinion. Reproduction on the website is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.