Source: official account: Master Xin, content from Tianfeng Securities Research Institute, Huaqiang Microelectronics, Quiksol electronic distribution and service, etc

Based on the signs of slow industry growth in the first quarter of this year, the market is more looking forward to performance in April. The Taiwan earthquake at the beginning of the month brought about a wave of storage "price increases"; The fluctuation of upstream metal material prices has led to consecutive price increase letters from downstream manufacturers; Some top original factory agents tend to clear inventory. At the same time, news of leading enterprises expanding production, the upcoming development of the next generation HBM, and breakthroughs in semiconductor technology challenges have also brought some joy and expectations to the industry. According to multi-party dynamics, April was relatively calm overall. Although the difficulty of "rapid recovery" is not small, signs of recovery are gradually emerging.

01 Macro data

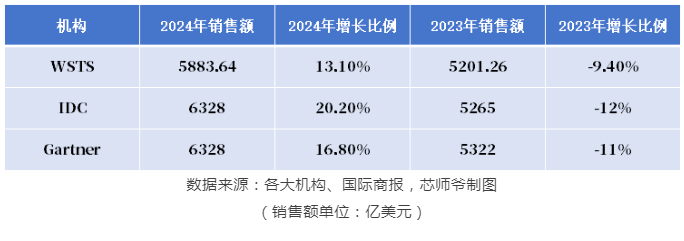

According to data and predictions from multiple mainstream institutions in the industry, major institutions hold a positive view on the semiconductor industry in 2024.

WSTS stated that due to the widespread adoption of generative AI, the demand for related semiconductor products is rapidly increasing, and storage demand is expected to show a significant recovery. It is expected that global semiconductor sales will increase by 13.1% in 2024, reaching a record high of $588.364 billion; IDC is more optimistic, expecting global semiconductor sales to reach $632.8 billion in 2024, a year-on-year increase of 20.20%; Gartner also expects global semiconductor sales to increase by 16.80% in 2024, reaching a total of $632.8 billion.

From the perspective of segmented categories, WSTS expects the three fastest-growing categories in 2024 to be storage, logic, and processors, with growth rates of 44.8%, 9.6%, and 7.0%, respectively. However, due to the impact of destocking and sluggish demand, the growth rate of analog chips is about 3.7%. Overall, storage products may become the key to the recovery of the global semiconductor market in 2024, and sales are expected to recover to the level of 2022.

02 April Review: Signs of recovery in the semiconductor industry are gradually emerging

*Interpretation of Major Events in Some Industries

1. US Department of Commerce updates new semiconductor export control regulations

Event: On April 4th Eastern Time, the third revision of the temporary final rules on export controls for advanced computing/supercomputers and semiconductor manufacturing items, issued by the Bureau of Industry and Security (BIS) of the US Department of Commerce, officially came into effect. This new regulation has refined and clarified the 1017 rule issued by the bureau on October 17, 2023, restricting the export of more advanced computers, AI chips, and semiconductor equipment to China.

Impact: Previously, the United States continuously increased its semiconductor export controls on China under the pretext of so-called "national security". In less than half a year, the semiconductor export control rules have been revised again, and controls on some laptops have been added, marking a further escalation of US restrictions on China in the fields of AI chips and semiconductor manufacturing equipment.

Export control makes the demand for domestic substitution of semiconductor equipment more urgent. Many institutions expect that in 2024, under the background of continuous expansion of large semiconductor factories in Chinese Mainland, the progress of domestic substitution of semiconductors is expected to further accelerate, and capital expenditure in mainland China is expected to rise steadily. Structurally, we are optimistic about the increasing demand for advanced process equipment driven by AI, and from a recovery perspective, we are optimistic about the order growth brought about by the quarterly improvement in the prosperity of packaging and testing factories for downstream packaging and testing equipment.

2. The soaring prices of metals such as gold and copper are transmitted to semiconductors

Event: Since early April, domestic copper prices have risen strongly. As of April 30th, the price has exceeded 80000 yuan, with an overall increase of over 10%. On a macro level, the financial attributes of copper are mainly related to the Federal Reserve's pace of interest rate hikes and cuts. Currently, against the backdrop of strong employment resilience and continuous inflation exceeding expectations in the United States, there is uncertainty in the market's expectations of the Fed's interest rate cuts. The US CPI rose by 3.5% year-on-year in March, reaching a new high since September 2023. The core CPI rose by 3.8% year-on-year, with the growth rate higher than expected for the third consecutive month; The US PPI rose 2.1% year-on-year in March, reaching a new high since April 2023.

On the other hand, in the early morning of April 13th, the UK and the US announced joint action to increase the ban on Russian metal exports and include the world's two largest metal exchanges in the ban, which could lead to a tightening of copper supply from Europe and the US. On April 17th, the operating license of Vale's Sossego copper mine in Brazil was suspended, with a copper production of 66800 tons in 2023.

Impact: Multiple factors are driving up upstream copper metal prices, affecting semiconductor industry quotes. Several semiconductor companies, including Shenzhen Chuangxin Microelectronics, Zhejiang Yaxin Microelectronics, Wuxi Huazhong Semiconductor Microelectronics, and Nanjing Zhiling Semiconductor, have issued price adjustment letters. Among them, Zhejiang Yaxin Micro has raised the unit price of its entire product line by 15% to 20%; The price increase of Wuxi Huazhongxin Micro is between 10% and 20%; The price increase of Shandong Taijixing packaging products is 10%. Regarding the reasons for price adjustments, the above-mentioned companies have all mentioned that it is due to the rise in prices of upstream metals and other raw materials, which has affected the quotation.

The surge in upstream metal prices has the most direct impact on the semiconductor industry, particularly in the chip packaging stage. And the core technologies of gold bump and copper nickel gold bump in this link have a clear demand for upstream materials such as gold and nickel. Not only copper, but also upstream metal materials including gold and nickel have seen significant price increases this year. Although the reasons for the price increase of the above-mentioned chip manufacturers are all due to the rise in raw material prices, it also reflects the recovery of market demand.

3. Taiwan earthquake disrupts semiconductor production across Taiwan

Event: On April 3, an earthquake of magnitude 7.3 occurred in the sea area of Hualien County, Taiwan, China, which was the largest earthquake 25 years after the "921" earthquake occurred in Taiwan in 1999. Taiwan is a major hub for the electronics industry in our country and even globally. It is home to many large companies such as TSMC, World Advanced, UMC, and TSMC. The earthquake has disrupted the semiconductor production in Taiwan.

Impact: TSMC and other wafer production lines experienced production line fragmentation and downtime. TSMC disclosed that the earthquake is expected to cause a loss of approximately 3 billion New Taiwan dollars (equivalent to 669 million yuan), while TSMC expects the earthquake to result in chip scrap losses of 500 million New Taiwan dollars (equivalent to 111 million yuan), and affect 5% to 8% of second quarter shipments. According to market estimates, the seven major wafer fabs in Taiwan have lost over NT $10 billion in the value of their online wafer production.

Micron, Samsung and other memory manufacturers have temporarily suspended their quotations for this. Affected by the earthquake, the supply chain is restricted and memory production capacity is reduced, but the global demand for memory has not decreased as a result. The imbalance between supply and demand has led to an increase in memory prices. Before the earthquake, major storage factories showed signs of increasing their quotes, mainly to make up for last year's operating losses. The occurrence of earthquakes has brought new variables to this price adjustment trend. According to TechInsight, given the known situation, there will be some short-term supply disruptions due to the Taiwan earthquake, which may be buffered by high inventory levels. The expected impact of the earthquake on the semiconductor industry is minimal, and long-term damage is unlikely to occur.

4. Apple releases latest supply chain list

Event: On April 22, Apple announced on its official website the supply chain list for the 2023 fiscal year, which includes 98% of Apple's global procurement of product materials, manufacturing, and assembly for the 2023 fiscal year. Among them, there are eight in and four out manufacturers in Chinese Mainland, and eight mainland enterprises newly entering the fruit chain are respectively Baoti, Jiuquan Iron&Steel, Zhongshi Weiye Technology, Kaicheng Technology, San'an Optoelectronics, Boshuo Technology, Tony Electronics and Zhenghe Group. The four companies that were removed from the list are Jiangsu Jingyan Technology, Meiyingsen Group, Shenzhen Derun Electronics, and Yishi. In Taiwan, China, China Southern Power returned to the list of Apple's supply chain after many years, and another new enterprise was Golden Arrow Printing Group. The four Taiwan, China enterprises removed from the fruit chain list are Lianyong, Nanya Branch, Jiaze and Tiding Technology.

Impact: It is widely recognized in the industry that entering the Apple supply chain means that the company has reached a high level of technological strength and product quality. Based on the roles of Apple's designers and salespeople, Apple can support other manufacturers. In this supply chain list adjustment, Chinese manufacturers are still the main presence in the fruit chain, but it also shows signs that Apple will reduce its dependence on domestic suppliers.

Regardless of the list of inbound and outbound fruit chains, it will also have a certain impact on the stock price, performance, and other aspects of the enterprise. It is worth noting that this may also reflect Apple's pursuit of global supply chain diversification and emphasis on risk management. In today's complex and ever-changing international trade environment, companies do need to pay more attention to the diversification of their supply chains to reduce risks.

03 Industry Policy Trends

1. New Policies to Promote the Development of Integrated Circuit Industry in Zhuhai, Guangdong Province

The Industry and Information Technology Bureau of Zhuhai City has issued a notice on soliciting opinions on the draft of several policy measures to promote the development of integrated circuit industry in Zhuhai City. It is suitable for enterprises involved in integrated circuit design, manufacturing, packaging and testing, equipment, materials, terminal applications, and related professional service platforms in the field of integrated circuits. Encourage high-quality enterprises to play a leading and driving role, and support the development of high growth innovative enterprises. The Zhuhai Industry and Information Technology Bureau will provide pre funding and supporting support for projects that focus on core and key technologies in the field of integrated circuits.

2. Shanghai launches the first national special environmental protection support policy for the integrated circuit industry

Shanghai has launched the first special environmental protection support policy for the integrated circuit industry in China, titled "Several Measures to Deepen Environmental Impact Assessment and Pollutant Discharge Permit Reform to Support the Development of the Integrated Circuit Industry" (referred to as the "Several Measures"), which was officially implemented on April 30th. The "Several Measures" propose a list of key industries for customized integrated circuit manufacturing and supporting projects. For projects listed in the key directory, strict environmental impact assessment approval and key supervision shall be implemented. Projects that are not included in the key list can enjoy simplified environmental impact assessments and maximum decentralization according to the city's environmental impact assessment reform policies.

In addition, the "Several Measures" also innovatively propose that when the information on the pollutant discharge permit of the integrated circuit industry is changed, the ecological environment department can add it to the pollutant discharge permit in a loose leaf format, reducing the number of times the enterprise changes the pollutant discharge permit and saving the operating costs of the enterprise.

3. Beijing: Increase the application of metaverse in consumer scenarios and support the research and development of intelligent terminals and other products

Eight departments including Beijing Bureau of Commerce, Beijing Municipal Bureau of Economy and Information Technology, Beijing Municipal Commission of Transport, Beijing Municipal Water Affairs Bureau, Beijing Agriculture and Rural Affairs Bureau, Beijing Municipal Bureau of Culture and Tourism, Beijing Municipal Bureau of Sports, and Beijing Municipal Bureau of Landscape and Greening jointly issued the "Action Plan for Promoting the Integration of Diversified Consumption Formats and High Quality Development".

The plan points out that it will support the docking of shopping malls, scenic spots, stadiums and other new Internet technology enterprises such as the Metauniverse, and promote the implementation of new immersive digital consumption scenarios such as VR, AR, and MR. And vigorously support the research and application of new products such as mobile intelligent terminals, smart homes, wearable devices, etc. By showcasing the latest digital sports equipment and technological products, new consumer formats and patterns are born, bringing consumers more convenient and innovative consumption scenarios.

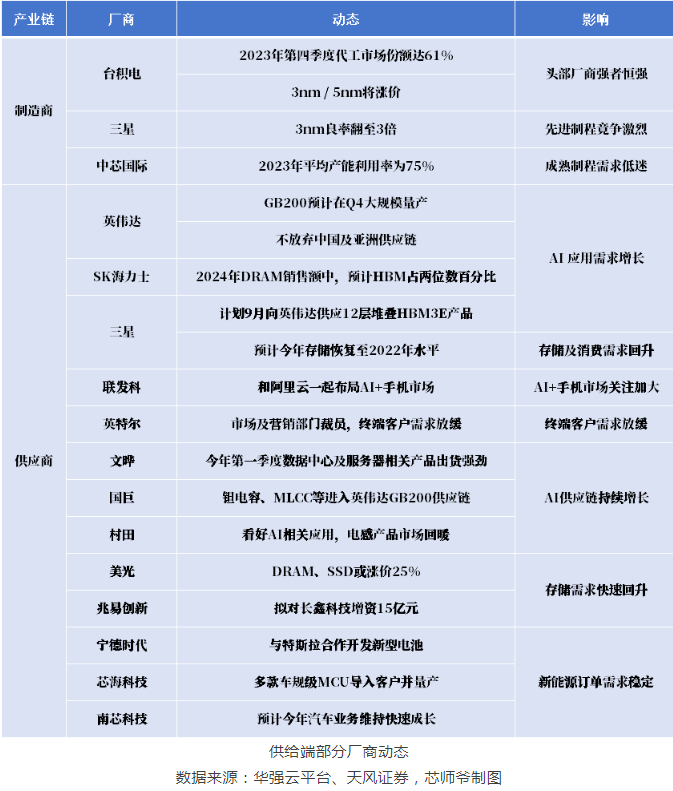

04 Supply side situation

The big event in April - the earthquake in Hualien, Taiwan, China, China, and the huge subsidies granted by the US government to a number of chip enterprises also affected major manufacturers. The earthquake in Taiwan has had a significant impact on the storage industry, with companies such as Micron, Samsung, and Hynix suspending their quotations one after another.

According to China Electronics News, seven semiconductor companies have received funding subsidies from the US government, including Samsung receiving $6.4 billion in subsidies to build a computer chip manufacturing and research and development industry cluster in Texas; TSMC receives $6.6 billion in subsidies to build three cutting-edge chip factories in Arizona; Intel receives $8.5 billion in subsidies to advance its commercial semiconductor projects in four states in the United States; Gexin has received a $1.5 billion subsidy to build a new factory in Malta, New York and expand existing production in the area; Microchip received a subsidy of $162 million to increase the company's chip and microcontroller production. Among them, TSMC, Samsung, and Micron all received the above-mentioned subsidies in April just now.

Furthermore, from the perspective of the spot market, compared to the peak procurement season in March, the market demand in April has significantly decreased. Although demand increased in March, it is still in a slow recovery stage. Under the influence of multiple factors, there were signs of a market downturn and recovery setbacks in April. The following are some of the top original factory delivery times and trends:

Microchip

The overall demand for Microchip in April was weak, and most products can now be delivered normally, but the average delivery time is relatively long, about 20 weeks. Some general products have a large inventory and no delivery pressure. Some production lines have been shut down due to low order volume, resulting in a shortage of orders. In addition, the current AI, automotive and other markets may become the main battlefield for its production capacity. In April, Microchip acquired VSI, which focuses on in vehicle network technology products, and Neuronix Al Labs, which can assist the AI market with FPGA products.

Financial report: Microchip has not yet released its latest financial report. However, according to Citigroup's forecast, given the conservative guidance of Microchip Technology, it is expected to report Q4 revenue of $1.35 billion for the 2024 fiscal year, a decrease of 24% compared to the previous period. Due to high sales and profit margins, it is expected that Q4 2024 earnings per share will be $0.58. Citigroup believes that the shipment volume of Microchip Technology has been far below demand, which is expected to bring some improvement to performance. It is expected that it will set its revenue guidance for the first quarter of the 2025 fiscal year at $1.4 billion, higher than the market's general expectation of $1.34 billion.

Trend: Starting this month, Microchip will have more inverted models on some low-end MCUs, and prices will continue to decrease for a period of time. However, the prices of most agents are still relatively firm.

TEXAS

In April, TI's market demand was weak, factory inventory pressure was high, and there was a phenomenon of inverted part numbers in the market. However, it is expected that this phenomenon will continue for a short period of time. In TI's first quarter financial report released this year, simulation revenue decreased by 14% year-on-year, and embedded processing revenue decreased by 22%. This trend is in line with TI's expectations. Currently, TI is preparing to compete for the market by lowering prices, especially for analog chips, which will adopt some tightening price control measures, as its growth trend leads to further price red lines raised by original manufacturers. It is expected that TI's shipment volume in the second quarter will slightly increase compared to Q1, and the shipment pressure will not be too great.

Financial report: On April 23rd, TI released its Q1 financial report, with revenue of $3.661 billion for the quarter, a year-on-year decrease of 16.40%. Net profit was 1.105 billion US dollars, a year-on-year decrease of 35.30%, but better than expected. According to its released robust guidance, customer inventory correction is nearing completion and demand is recovering. TI's optimistic forecast suggests that the downward trend in demand for industrial and automotive components may ease. For Q2, the expected revenue is between 3.65-3.95 billion US dollars.

Trend: TI's market is currently in the stage of clearing inventory, and prices will continue to decline in the short term. As the original factory prices tighten, the market price of TI gradually returns to stability, and its demand is also gradually recovering, showing a slow growth trend in the long run.

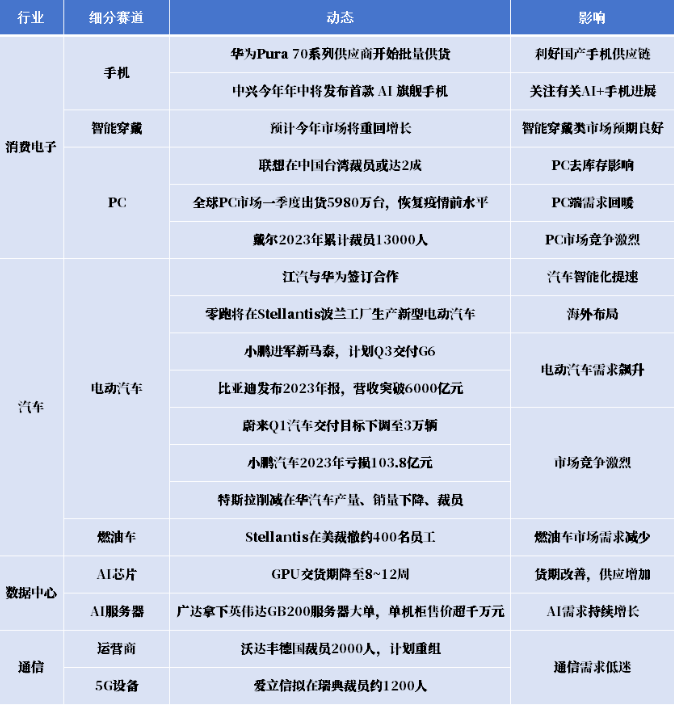

05 Demand side situation

The inventory reduction of electronic industry products such as storage and panels has been basically completed or is nearing completion. The shipment of mobile phones and PCs on the consumer electronics side has significantly rebounded, coupled with the emergence of new demand for AI. There will be numerous heavyweight AI smartphones and AI PCs released next. Overall, the fundamentals of electronics are gradually improving, and AI models continue to upgrade, empowering consumer electronics. The continued sluggish demand in the communication field is still in a slow recovery stage, with data showing that its market demand growth is less than 10%.

The following is a dynamic analysis of some key terminal markets:

1. Huawei is expected to drive the recovery of domestic supply chain on mobile devices

In the first quarter of this year, Huawei's mobile phone sales in the Chinese Mainland market returned to the first place, which is expected to drive the recovery of the domestic supply chain. Canalys data shows that Huawei's Q1 mobile phone market share in Chinese Mainland reached 17%, compared with 10% in the same period last year, a significant increase year on year. This time, Huawei returned to the top of China's smartphone market after 13 quarters.

With the "replacement wave" brought by Huawei phones and the continuous increase in market share under the AI wave, in terms of supply chain, AI increment (NPU+storage) and the increase in mobile phone market share will bring more opportunities to the domestic supply chain. Specifically for some sealed off factories, their capacity utilization rate will return to a higher level, and the off-season will not be weak, exceeding market expectations.

2. AI side application acceleration

(1) Currently, major cloud providers are increasing their AI capital expenditures

Meta has raised its capital expenditure for 2024 from $30-35 billion to $35-40 billion, mainly to increase investment in AI product development and the construction of required data center facilities; Google's Q1 2024 capital expenditure was $12 billion, a year-on-year increase of 91% and a month on month increase of 9.2%; Microsoft's capital expenditure in Q1 2024 was $14 billion, a year-on-year increase of 79.4%, and it stated that it will continue to expand its AI capital expenditure.

(2) Major manufacturers accelerate the promotion of AI smartphones and AI PCs

Lenovo has released a series of AI PC products with built-in Lenovo small and large models; Apple has released the OpenELM model, a large language model specifically designed for mobile devices such as smartphones, which includes four models with 270 million, 450 million, 1.1 billion, and 3 billion parameters. It has functions such as generating text, code, translation, and summarization.

*Disclaimer: The content of the article is the author's personal opinion. Reproduction on the website is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.