Source: official account: semiconductor localization

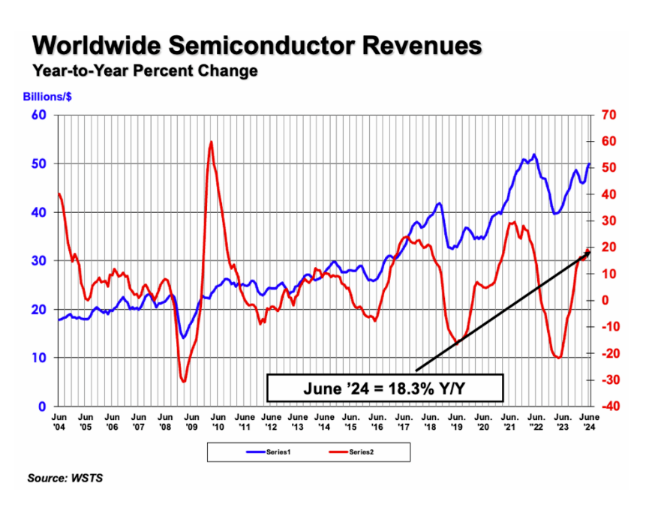

The Semiconductor Industry Association (SIA) announced that global semiconductor industry sales totaled $149.9 billion in the second quarter of 2024, an increase of 18.3% compared to the second quarter of 2023 and 6.5% compared to the first quarter of 2024. The sales revenue for June 2024 was $50 billion, an increase of 1.7% compared to $49.1 billion in May 2024. The monthly sales revenue is compiled by the World Semiconductor Trade Statistics (WSTS) organization and represents a three-month moving average. By revenue, SIA's chip companies account for 99% of the US semiconductor industry and nearly two-thirds of the non US semiconductor industry.

SIA President and CEO John Neuffer said, "The global semiconductor market remained strong in the second quarter of 2024, with quarterly sales showing growth for the first time since the fourth quarter of 2023. Sales in June increased both month on month and year-on-year, with the Americas market leading with 42.8% growth compared to June 2023

From a regional perspective, except for the year-on-year growth in the Americas, sales in Chinese Mainland (21.6%) and Asia Pacific/all other regions (12.7%) increased, but sales in Japan (-5.0%) and Europe (-11.2%) declined. Monthly sales in the Americas (6.3%), Japan (1.8%) and Chinese Mainland (0.8%) increased in June, but monthly sales in Europe (-1.0%) and Asia Pacific/all other markets (-1.4%) declined.

2024 starts slowly, but is ready for growth

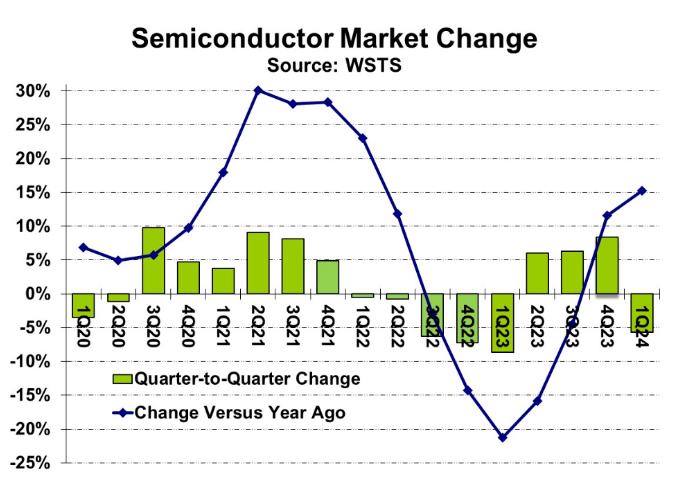

According to WSTS data, the global semiconductor market size for the first quarter of 2024 was $137.7 billion. The first quarter of 2024 decreased by 5.7% compared to the fourth quarter of 2023, and increased by 15.2% compared to the same period last year. The first quarter of this year usually shows a seasonal decline compared to the fourth quarter of the previous year. However, the 5.7% decline in the first quarter of 2024 was worse than expected.

The performance of major semiconductor companies in the first quarter of 2024 was mixed. The revenue changes from Q4 2023 to Q1 2024 range from a 23% increase reported by Micron Technology to a 19% decrease reported by STMicroelectronics. The revenue of 5 companies increased month on month, while the revenue of 9 companies decreased. Nvidia continues to be the largest semiconductor company with revenue of $26 billion. The total revenue of the top ranked companies increased by 2%, storage chip manufacturers increased by 12%, and non storage manufacturers decreased by 2%.

The company has provided different revenue guidance for the second quarter of 2024. Micron expects continued strong demand for storage chips, with revenue expected to increase by 13% in the second quarter of 2024 compared to the first quarter of 2024. The other seven companies expect their revenue to increase in the second quarter of 2024. Artificial intelligence (AI) is listed as a major growth driver by Nvidia, Samsung, and SK Hynix. NXP Semiconductors expects the second quarter of 2024 to be on par with the first quarter of 2024. Three companies are expected to decline. Qualcomm and MediaTek see a seasonal decline in smartphones. STMicroelectronics has the lowest revenue guidance, with a decrease of 7.6% due to excess inventory in the industrial sector. The 12 companies providing guidance have a comprehensive outlook of 3% growth for the second quarter of 2024.

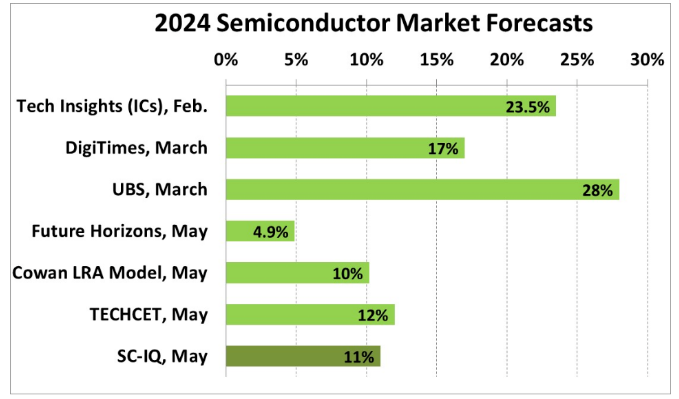

Recent estimates of the semiconductor market growth rate for 2024 range from 4.9% to 28%. However, the forecast since the release of WSTS first quarter data in early May is significantly different from previous forecasts. The forecast range released in February and March ranges from 17% for DigiTimes to 28% for UBS. According to WSTS data for the first quarter of 2024, Future Horizons has lowered its forecast for 2024 from 16% in January to 4.9% in May. The other May forecasts come from 10% of the Cowan LRA model and 12% of TECHCET. Semiconductor Intelligence (SC-IQ) has lowered its expected growth rate for 2024 from 18% in February to 11% in May.

We pointed out in our April 2024 newsletter that there should be steady growth in key terminal markets such as PCs and smartphones in 2024. Some markets that have seen growth in the past few years, such as automotive and industrial, seem to be weakening. Artificial intelligence is an emerging growth driver. According to data from the International Monetary Fund, it is expected that the global economy will steadily grow by 3.2% in the next two years. These factors should support the healthy growth of the semiconductor market in 2024 and 2025. However, earlier predictions of a 20% or higher growth in 2024 are unlikely to prove correct.

Recovery of wafer foundry industry

With the increase in electronic sales, stable inventory, and increased wafer fab capacity, the global semiconductor manufacturing industry shows signs of improvement in the first quarter of 2024. It is expected that the industry will experience stronger growth in the second half of the year.

Morgan Stanley (Morgan Stanley) Securities stated in its latest report on the "wafer foundry industry" that the destocking of wafer foundry inventory will come to an end, and the industry's prosperity will widely recover in the second half of 2024 and further strengthen in 2025.

Gokul Hariharan, director of the research department in Taiwan, China, Xiaomo, analyzed that the boom bottomed out in the first quarter. In addition, AI demand continued to rise, and non AI demand also gradually recovered. More importantly, urgent orders began to appear, including large size panel driver IC (LDDIC), power management IC (PMIC), WiFi 5 and WiFi 6 chips, all of which clearly showed that the wafer foundry industry was out of the bottom and turned to recovery.

It is worth noting that the capacity utilization rate of wafer foundries in Chinese Mainland recovered rapidly, mainly because the mainland's fabless semiconductor companies began to adjust their inventory earlier. After the first six quarters of active destocking, the inventory is gradually normalized.

In terms of non AI demand, vertical areas such as consumer, communication, and computing in the 3C sector also hit bottom in the first quarter of this year; However, demand for automobiles and industries may recover by the end of 2024 or early 2025, mainly due to a later overall inventory adjustment.

SEMI pointed out that the sales of electronic terminal products increased by 1% annually in the first quarter of this year, while IC sales grew strongly by 22% compared to the same period last year. It is expected that the sales of electronic terminal products will increase by 5% annually in the second quarter. In addition, the increase in shipments of high-performance computing (HPC) chips and the continuous improvement in memory prices will also drive IC sales to maintain strong growth, with an annual increase of 21%. The IC inventory level has also stabilized in the first quarter and is expected to further improve this quarter.

However, SEMI admitted that the utilization rate of wafer fabs' production capacity is still low, especially in mature process areas, which is still a concern. It is expected that there will be no signs of recovery in the first half of this year, and the memory utilization rate in the first quarter is lower than expected, mainly due to strict supply control.

The capital expenditure of wafer fabs is consistent with the trend of capacity utilization, maintaining conservatism. The expenditure in the fourth quarter of last year decreased by 17% year-on-year, and continued to decline by 11% in the first quarter. It is expected to return to growth in the second quarter, with a slight increase of 0.7%. It is expected that the capital expenditure related to memory will increase by 8%, which is higher than that in the non memory field.

SEMI Global Senior Director Zeng Ruiyu stated that some semiconductor demand is recovering, but the pace of recovery is not consistent. The demand mainly comes from AI chips and high bandwidth memory (HBM), driving investment and capacity expansion in related fields. However, due to the dependence of AI chips on a few key suppliers, the benefits to IC shipment growth are limited.

Boris Metodiev, Director of Market Analysis at TechInsights, stated that semiconductor demand was mixed in the first half of this year due to a surge in demand for generative AI and a rebound in memory and logic. However, slow recovery in the consumer market, coupled with inventory adjustments in the automotive and industrial markets, disrupted the markets for analog ICs and discrete components.

Metodiev expects that as AI gradually spreads to edge devices, it is expected to drive consumer demand, and semiconductors are expected to fully recover in the second half of this year. In addition, as the Federal Reserve lowers interest rates, it will increase consumer purchasing power and drive down inventory levels, and the automotive and industrial control markets will return to growth in the second half of this year.

Disclaimer: This article is reproduced or adapted online, and the copyright belongs to the original author. The content of the article is the author's personal opinion. Reproduction is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.