Source: Content from Semiconductor Chip News (ID: MooreNEWS) Comprehensive

Today, ASML, the leader in lithography machines, released its Q2 revenue report.

ASML stated that in the second quarter of 2024, the company achieved net sales of 6.2 billion euros, which is at a high level in the projected revenue range, mainly due to the increase in sales of immersive systems. Among them, 1.48 billion euros came from the installation management business, slightly higher than expected due to the increase in installation service revenue. In terms of gross profit margin data, ASML recorded a performance of 51.5% this quarter, higher than previously expected. According to ASML, this is mainly influenced by the product portfolio, mainly due to the increase in sales of immersion lithography systems. In terms of net profit, ASML achieved a revenue of up to 1.6 billion euros in this quarter.

In terms of new orders, ASML added 5.6 billion euros in the second quarter of this year, of which 2.5 billion euros were EUV lithography machine orders. It is worth mentioning that as of the end of the second quarter of 2024, ASML's total outstanding orders reached 39 billion euros.

According to the data released by ASML, the company sold 89 new lithography systems in the second quarter of this year, a significant increase compared to the 66 systems sold in the first quarter. In terms of sales data for second-hand lithography systems, the company also achieved a performance of 11 units, which is higher than the 4 units in the first quarter.

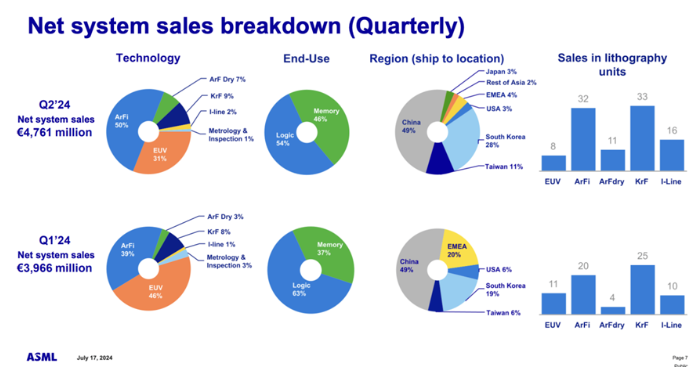

As shown in the figure below, out of the 100 lithography machines sold by ASML in the second quarter, 32 were KrF lithography machines, 32 were ArFi lithography machines, and eight were EUV lithography machines. It is worth mentioning that in the second quarter, ASML also sold 16 i-line lithography machines.

According to the distribution area, as shown in the figure, the sales of lithography systems in Chinese Mainland accounted for 49% in this quarter. Following closely behind are South Korea, Taiwan EMEA、 As for the United States, it only accounts for 3%, and sales in Japan have also risen to 3%. Compared to the first quarter data, it can be seen that sales in Japan, Taiwan, and South Korea have also experienced significant growth.

In the past few quarters, the overall inventory level of the semiconductor industry has continued to improve. At the same time, we have also seen that the utilization rate of lithography equipment by both logic chip and storage chip customers is further increasing. Despite the uncertainty mainly caused by the macro environment, we expect the semiconductor industry to continue to recover in the second half of the year, "said Fu Keli, President and CEO of ASML.

Looking ahead to the next quarter, ASML stated that its net sales for the third quarter of 2024 are expected to be between 6.7 billion and 7.3 billion euros, with an estimated 1.4 billion euros coming from its installation management business. The gross profit margin is expected to be between 50% and 51%.

From Fu Keli's introduction, we learned that ASML's expectations for the full year of 2024 remain unchanged, with overall revenue expected to be basically the same as in 2023. As previously stated, and based on our current forecast, the performance in the second half of this year will be significantly stronger than in the first half, which is consistent with the trend of the semiconductor industry continuing to recover from the downward cycle, "Fu Keli emphasized.

ASML's specific expectations for segmented markets are similar to those of previous quarters.

The revenue from the logic chip field in 2024 will be slightly lower than that of 2023, as customers are still digesting the new production capacity in 2023; while in the storage chip field, the revenue in 2024 is expected to be higher than last year, mainly driven by the transformation of dynamic random access memory (DRAM) technology process nodes to support advanced storage technologies such as fifth generation double data rate synchronous dynamic random access memory (DDR5) and high bandwidth memory (HBM). ”Fu Keli said.

Fu Keli emphasized, "As mentioned earlier, 2024 is an adjustment year, and we are continuously investing in capacity improvement and technological development to prepare for strong demand in 2025. Based on the different factors discussed in the past two quarters and their impact on profit margins, we still expect the gross profit margin in 2024 to be slightly lower than that in 2023

Regarding EUV lithography machines, Fu Keli shared that ASML shipped a new batch of NXE: 3800 E systems to customers in the second quarter for the 0.33 numerical aperture EUV lithography system, and is continuing to increase production capacity as planned. Due to the shift in customer demand towards NXE: 3800 E this year, the company expects that the majority of equipment shipped in the second half of the year will be NXE: 3800 E systems. ASML shipped its second equipment to customers in the second quarter for the 0.55 High NA EUV lithography system. ASML has revealed that the company's first high numerical aperture equipment is undergoing wafer qualification testing at the customer's factory. The second device is currently being assembled and progressing quite smoothly.

Overall, we have a good development momentum in High NA EUV, with strong customer interest and good progress in meeting customer expectations. ”Fu Keli said.

In ASML's view, the strong development of artificial intelligence is currently becoming a powerful driving force for the recovery and growth of the semiconductor industry, leading other segmented market areas. Based on discussions with clients and the company's large backlog of undelivered orders, ASML expects 2025 to be a strong year for performance.

Fu Keli also pointed out that the long-term demand in the semiconductor terminal market remains strong, and energy transformation, electrification, and artificial intelligence will continue to bring demand. We see that the space for application areas is constantly expanding, and the demand for lithography at future technological process nodes is also increasing, which will drive the demand for both advanced and mature processes.

Therefore, ASML predicts that the semiconductor industry will enter an upward cycle by 2025. As a result, many wafer fabs under construction will be put into use worldwide, and ASML also needs to prepare for this, as these fabs plan to purchase ASML's systems.

We will continue to focus on the future and prepare our production capacity for further long-term growth. As stated at the investor day in November 2022, our net sales are expected to be 30 billion to 40 billion euros by 2025 and 44 billion to 60 billion euros by 2030, "Fu Keli reiterated. Overall, although the macro environment still brings uncertainty in the short term, we are confident in long-term growth opportunities

Disclaimer: This article is reproduced or adapted online, and the copyright belongs to the original author. The content of the article is the author's personal opinion. Reproduction is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.