Source: Content compiled from SIA by Semiconductor Industry Observation (ID: icbank)

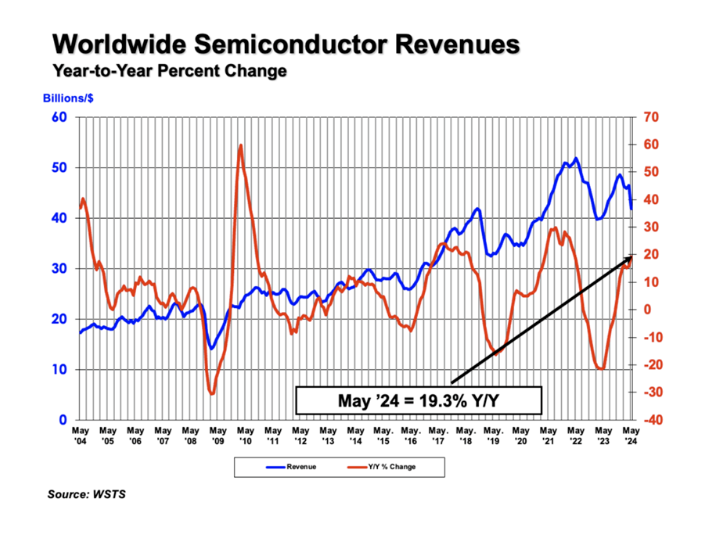

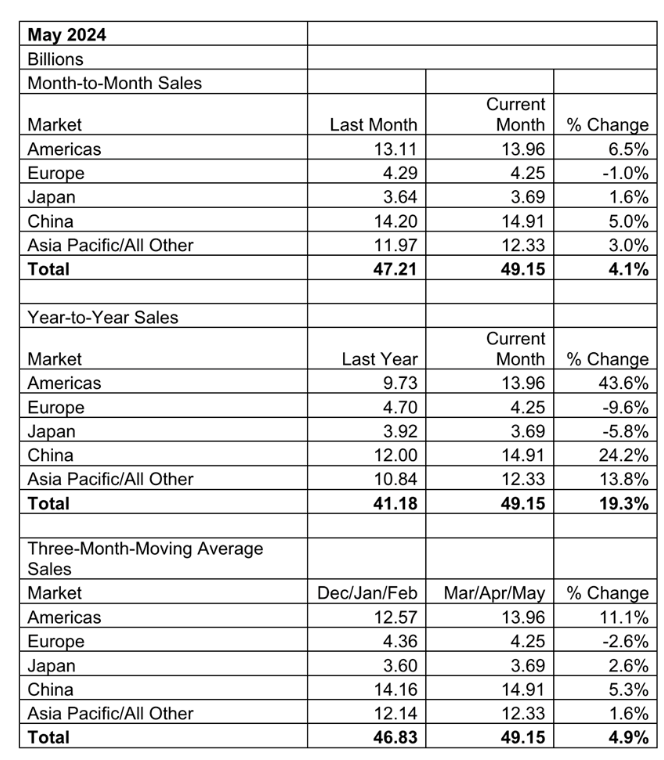

The Semiconductor Industry Association (SIA) announced today that global semiconductor industry sales reached $49.1 billion in May 2024, an increase of 19.3% compared to $41.2 billion in May 2023 and an increase of 4.1% compared to $47.2 billion in April 2024.

SIA President and CEO John Neuffer said, "Every month in 2024, the global semiconductor market achieved year-on-year growth, with the sales growth rate in May reaching the largest increase since April 2022. The growth in the Americas market was particularly strong, with sales increasing by 43.6% year-on-year.

From a regional perspective, sales in the Americas (43.6%), China (24.2%), and Asia Pacific/all other regions (13.8%) increased year-on-year, but sales in Japan (-5.8%) and Europe (-9.6%) decreased. In May, sales in the Americas (6.5%), China (5.0%), Asia Pacific/All Other Regions (3.0%), and Japan (1.6%) increased month on month, but sales in Europe (-1.0%) decreased.

The current situation and prospects of semiconductor supply chain in 2024 and beyond

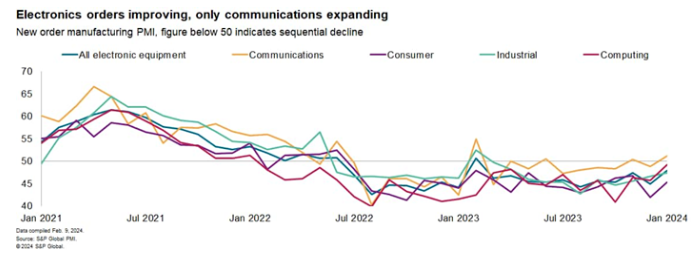

From top to bottom, semiconductor demand is weak and the electronic equipment manufacturing industry is sluggish. The S&P Global Manufacturing Purchasing Managers' Index shows that new orders have been on a downward trend for 18 out of the past 19 months.

We have seen some signs of recovery, with the decline rate decreasing and new orders for communication equipment increasing. This is still a long way from the expansion rate during the prosperous period of 2021. There are also signs of recovery in semiconductor exports from major manufacturing centers such as Taiwan and South Korea.

In the context of stagnant sales of general computing infrastructure, the demand for generative artificial intelligence has provided a welcome driving force for silicon wafer, system, and cloud suppliers. This market is still in the early stages of its development cycle.

The huge demand for GPUs is mainly driven by a small number of forward-looking companies building their own basic platforms. In addition, players in Chinese Mainland scramble to buy as many advanced GPUs as possible before further export restrictions take effect. After this craze, most commercial companies may experience a period of calm before being prepared to use these models on a large scale in truly revenue generating applications. This time depends on the usual development, testing, and preview sequence before achieving universal availability.

Large scale training is the most urgent need today, but as time goes on, inference is the biggest market opportunity so far. Therefore, as demand increases, some of the large training clusters established today may be repurposed for inference - while digesting excess capacity, it may slow down overall infrastructure sales.

Large scale enterprises use GPUs in two ways: internally, pre training their own large base models for customer use; External use, allowing customers to run their own AI models and code using GPU driven instances. They are increasingly developing their own customized silicon accelerators as supplements or alternatives to GPUs.

Unless performance and efficiency can be doubled, the expected growth in data center capacity over the next decade will not be achieved. This transformation is a significant disruption for the semiconductor industry.

The capital expenditures of the four ultra large scale data center operators who released relevant data reached 30.8 billion US dollars in the fourth quarter of 2023, a year-on-year increase of 15% and a 95% increase compared to the same period in 2019.

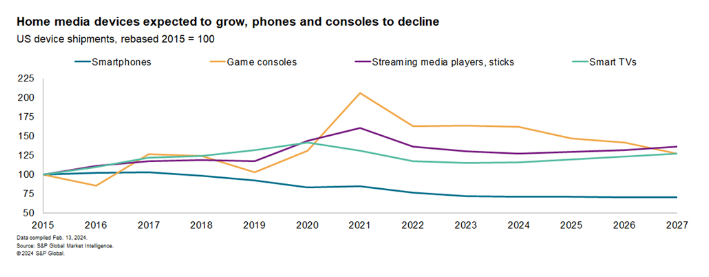

In the past five years, the shipment volume of consumer devices has driven the semiconductor industry through a cycle of ups and downs. In the long run, the global consumer technology and related platform market is directly related to the launch of next-generation connectivity (through fiber optics and 5G), which will become increasingly mature in 2024 and further accelerate market development.

New products and applications will continue to emerge, many of which are driven by artificial intelligence and rely on on-chip system technologies that accelerate AI by integrating CPUs, GPUs, and neural processing units (NPUs). Many PC manufacturers hope that the "artificial intelligence PC" to be launched later in 2024 can stimulate demand.

In the short term, our forecast shows that North American smartphone shipments have been continuously declining since 2016 and are not expected to recover until 2027. The shipment volume of home media devices, including video game consoles, televisions, and streaming media, increased by 16% in 2020, 10% in 2021, and then decreased by a total of 17% in 2022 and 2023. The shipment volume of gaming consoles is expected to decline, while streaming and smart TVs are expected to only grow by 1% to 3% in the next four years.

Artificial intelligence use cases are likely to become the main driving force for infrastructure sales located outside of centralized public clouds and data centers, close to end-users, networked machines, and sensors. The global mobile industry is undergoing a digital transformation that is changing the industry - for example, the in car and out of car infrastructure needed to support the vision of connected cars may enable autonomous driving.

These all heavily rely on intelligent edge infrastructure deployed, managed, and owned by original equipment manufacturers, industry suppliers, hyperscale enterprises, data center providers, and 5G service providers. Continuing to supply less cutting-edge 'traditional' semiconductors and ultra-low power chips with additional embedded intelligence is an important component of this vision.

Reusable consumer chips and emerging architectures (RISC-V cores, software IP, and chips) must be adopted faster by current embedded processing and microcontroller chip experts, who are not always at the forefront of technological innovation.

The inevitable challenge is that the industry may have bright long-term prospects, but the short-term prospects are bleak. This is particularly evident in the middle end of the technology supply chain, where exports of some semiconductor products have not yet recovered. The trade data of semiconductor components will become a key indicator for tracking the recovery of actual chip demand.

Reference link

https://www.semiconductors.org/global-semiconductor-sales-increase-19-3-year-to-year-in-may/

Disclaimer: This article is reproduced or adapted online, and the copyright belongs to the original author. The content of the article is the author's personal opinion. Reproduction is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.