Source: Compiled from eetimes by Semiconductor Chip News (ID: MooreNews), Author: Takashi Tang

Due to the special demand brought by the coronavirus, the global semiconductor market reached a historic high of $574 billion in 2022. However, in 2023, special needs will come to an end and the economy will enter a recession, with a decline of approximately 8% to $526.9 billion. This year (2024), the economy is expected to recover from the recession, reaching US $611.2 billion, exceeding the peak of COVID-19's special demand.

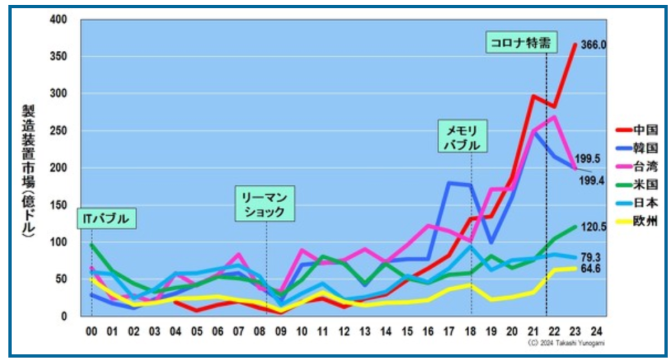

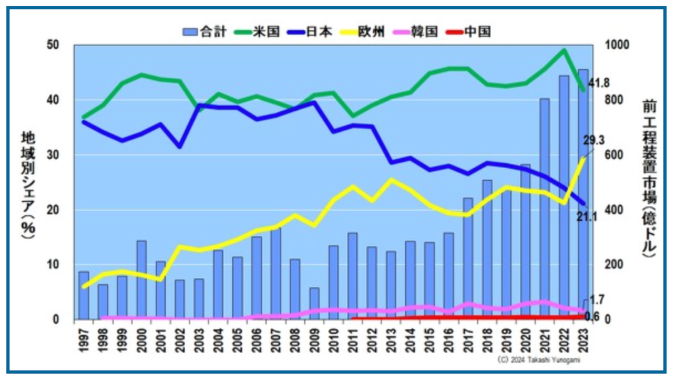

At the same time, like the semiconductor market, the equipment market reached a historic high of $107.6 billion in 2022 due to the special demand brought by the coronavirus. However, by 2023, when the semiconductor market experiences a significant decline, the equipment market size will reach $106.3 billion, a decrease of only $1.3 billion (2%). In other words, it can be said that there will be significant differentiation in the behavior of the semiconductor and equipment markets in 2023 (Figure 1).

So why did this difference occur? This article argues that this difference is due to China's large-scale purchase of lithography equipment, which is subject to export restrictions from the United States. Next, we will analyze the shipment value trends of major front-end equipment manufacturers and explain the rapid progress of Chinese manufacturers such as NAURA and AMEC. Finally, we need to reveal a fact that the share of front-end processing equipment in Japan continues to decline and will fall to third place by 2023, second only to the United States and Europe.

Japan's semiconductor policy is moving towards directions that are unlikely to be implemented, such as Rapidus and TSMC's Kumamoto factory, and there is no indication that the company will take any measures to enhance the competitiveness of equipment manufacturers. Therefore, we can only rely on the self rescue efforts of various device manufacturers to cope with the crisis of declining front-end device market share. We can only hope that the front-end equipment industry will not become like Japan's semiconductor device industry.

China is rapidly growing in the regional equipment market

The reasons for the differences in the global semiconductor and equipment market in 2023 can be clarified by examining the equipment market by region (Figure 2). From 2022 to 2023, Taiwan and South Korea will experience significant declines, while China and the United States will experience significant growth. Furthermore, Japan and Europe seem to be almost evenly matched.

Here, we have summarized the equipment markets of various countries and regions in 2022 and 2023, as well as their fluctuations from 2022 to 2023. It is estimated that by 2023, Chinese Mainland will increase by US $8.33 billion, the United States by US $1.57 billion, Europe by US $180 million, South Korea by US $1.56 billion, Taiwan, China by US $6.88 billion, Japan by US $420 million, and other regions by US $2.3 billion. In total, the global economy is expected to decline by $1.39 billion from 2022 to 2023.

In other words, it can be said that the increase or decrease in the global device market, which appears almost flat at first glance, varies greatly depending on the different countries and regions. Among them, the Chinese equipment market, which has become the world's largest, has grown particularly rapidly. So, why did the Chinese equipment market grow so much in 2023 despite the economic recession?

Photolithography equipment is rapidly expanding due to the shipment of various front-end equipment

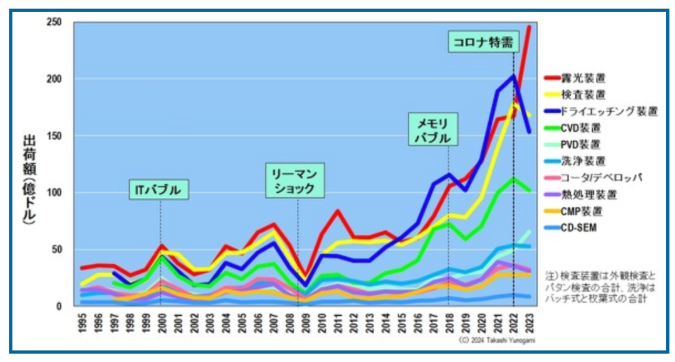

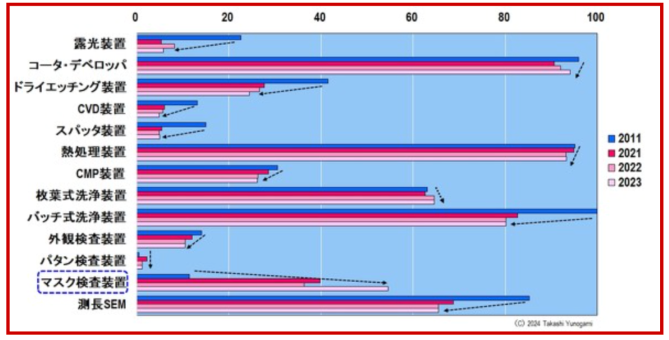

Figure 4 shows the shipment trend of various front-end devices. In addition, the figure depicts the total of visual inspection and pattern inspection of the inspection device, as well as the total of batch and single piece cleaning devices.

Now, looking at the chart again, we can see that in 2023, when special demand collapses due to the pandemic, many equipment markets, such as dry etching equipment, inspection equipment, and CVD equipment, will decline. However, the exposure equipment market rapidly expanded, surpassing the previously ranked dry etching equipment market and becoming the largest market with $24.6 billion. In addition, PVD equipment is also growing, although at a slower pace than exposure equipment (the reasons for this will be discussed later).

Here, in 2023, when the semiconductor recession hit, China's equipment market is growing significantly, and the exposure equipment market is rapidly expanding. These two things are considered related. The reasons are as follows.

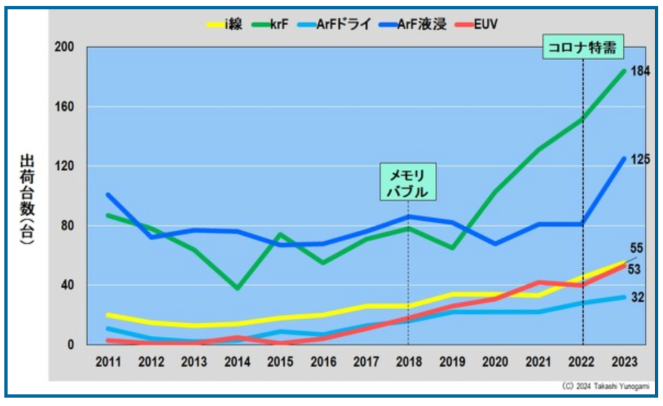

On October 7, 2022, the United States imposed export restrictions on equipment that can manufacture advanced semiconductors from China. Japan and the Netherlands have also decided to align with US regulations, with Japan suspending exports of ArF immersion equipment and other devices from July 2023, the Netherlands suspending exports from September 2023, and Japan imposing export restrictions on 23 items.

Therefore, some people believe that China ordered a large amount of ArF immersion solution at the last minute (ignoring economic principles) before implementing export restrictions in Japan and the Netherlands. This may be a factor contributing to the rapid expansion of the Chinese equipment market and the rapid growth of the exposed equipment market in 2023.

The same phenomenon can also be seen in the shipment value trend of front-end equipment manufacturers.

ASML's shipment volume jumps to the top of front-end equipment manufacturers' list

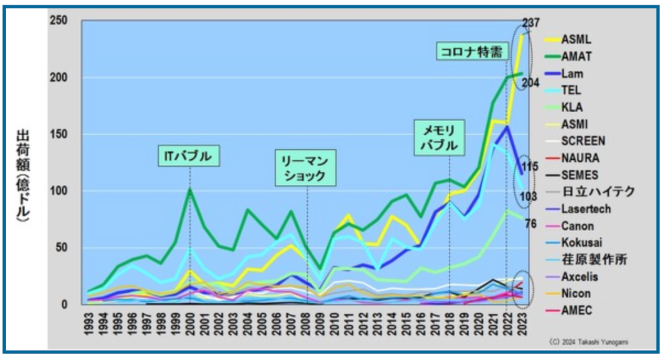

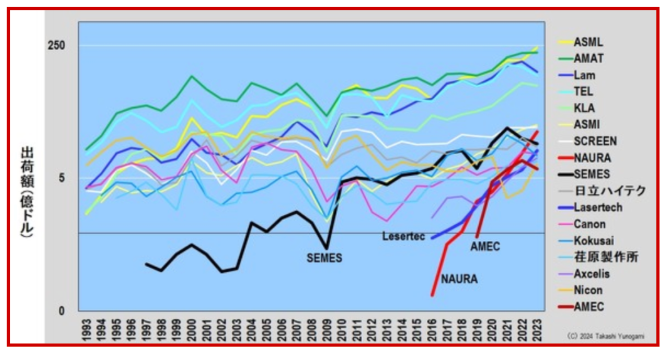

The following figure shows the trend of shipment values for major front-end equipment manufacturers. From 2022 to 2023, American Applied Materials Company (AMAT) saw slight growth, while Lam Group, Tokyo Electronics (TEL), and KLA declined. Meanwhile, ASML, whose main business is exposure equipment in Europe, experienced rapid growth, and AMAT caught up with them, jumping to the top of the mountain.

The reason behind this is believed to be the large volume of ArF immersive orders from China, which can be clearly seen from ASML's shipment trend by exposure equipment. ASML ships approximately 80 ArF immersion devices annually. However, by 2023, the shipment volume of ArF immersion devices will be 125, approximately 1.5 times its quantity. Most of the increase seems to have been exported to China.

To summarize, when the semiconductor recession hit in 2023, the global equipment market remained almost flat because when ASML from the Netherlands and the United States imposed export restrictions on China, we can assume that it was because they placed a lot of orders. As a result, the Chinese equipment market has grown rapidly, the exposure equipment market has expanded rapidly, and ASML's shipment volume has jumped to the top among equipment manufacturers.

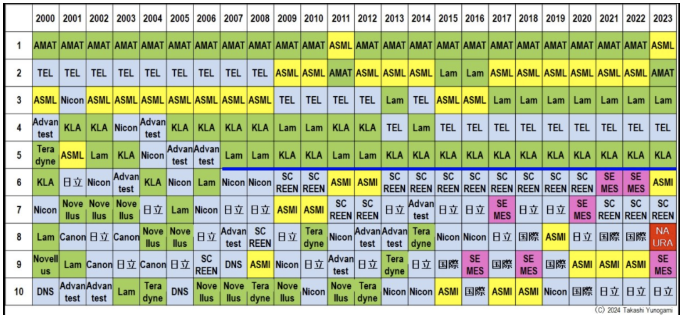

The difference between the top five and bottom five in terms of shipment volume ranking

Now looking at Figure 5, we see ASML ranked first in shipment volume ($23.7 billion), AMAT ranked second ($20.4 billion), Lam ranked third ($11.5 billion), and TEL ranked fourth ($10.3 billion). ). There is a significant difference. There is also a significant gap between the third, fourth, and sixth place KLA (7.6 billion US dollars). Moreover, there is a significant gap between fifth place and above and sixth place and below. Simply put, there is a huge gap between the fifth and above positions and the sixth and below positions.

But in Figure 5, the behavior of device vendors ranked 6th and below is not clear, so I drew a logarithmic chart on the vertical axis (Figure 7). The results indicate that SEMES in South Korea is growing. In addition, since 2016, NAURA in China has grown rapidly, and Lasertec in Japan has also grown rapidly. In addition, research has found that AMEC in China has been growing since 2018.

North China Huachuang Equipment Ranking Enters Top Ten

Here, we have listed the trend of the top 10 device manufacturers in terms of sales since 2000 (Figure 8). Firstly, we can see that the top five manufacturers have been fixed since 2007. However, the ranking of the top five may occasionally change.

On the other hand, the rankings below sixth place vary greatly every year, but SEMES has consistently entered the top ten since 2016. In 2023, North China Huachuang ranked 8th for the first time.

This is the first time that Chinese equipment manufacturers have entered the top ten. Therefore, this is a rather epoch-making event. In addition, regarding the shipment volume of various pre processes shown in Figure 4, it indicates that although many equipment will decrease in 2023, exposure equipment and PVD equipment will increase. The increase in PVD equipment seems to be due to the increase in NAURA shipments.

Another Chinese equipment manufacturer, Microelectronics, ranked 17th as of 2023, may still need a considerable amount of time to enter the top ten. However, with sales already on par with Nikon, Zhongwei may become an undeniable device manufacturer in the future, just like Northern Huachuang.

Proportion of various front-end process equipment in each company in 2023

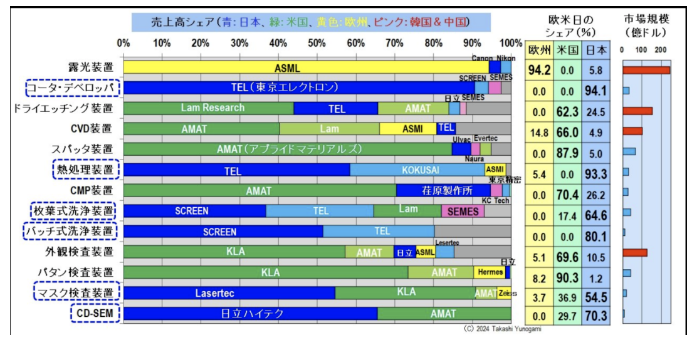

Figure 9 summarizes the front-end device market share of each company, as well as the market share in Europe, the United States, and Japan, and the market size in 2023.

Firstly, looking at the market share in Europe, America, and Japan, ASML holds a 94.2% monopoly on exposure equipment in Europe. In the United States, there are three companies centered around AMAT, Lam, and KLA, including dry etching equipment (62.3%), CVD equipment (66.0%), sputtering equipment (87.9%), CMP equipment (70.4%), and visual equipment. Inspection equipment (69.6%) and type inspection equipment (90.3%).

On the other hand, in Japan, coating/developing machines (94.1%), heat treatment equipment (93.3%), single piece cleaning equipment (64.6%), batch cleaning equipment (80.1%), mask inspection equipment (54.5%), and CD-SEM (70.3%) have the highest proportion.

But the equipment market with a high market share in Japan is not very large in size. On the other hand, Europe and America hold a global market share in front-end devices, with a market size exceeding 10 billion US dollars. ASML accounts for 94.6% of the $24.6 billion exposure equipment, Lam and AMAT together account for 62.3% of the $15.4 billion dry etching equipment, KLA and AMAT account for 69.6% of the $12.7 billion visual inspection equipment, and 69.6%. AMAT and Lam account for 66.0% of the $10.2 billion CVD equipment.

That is to say, AMAT, ASML, Lam, and KLA from Europe and America focus on equipment with larger market sizes, monopolizing global market share. There seems to be a top-down strategy based on marketing.

So, what is the regional share of all front-end processes?

The market share of front-end equipment in Japan continues to decline

I first noticed something strange two years ago in the summer of 2022.

As is well known, Japan's semiconductor device industry has been severely damaged, but I originally thought that Japan's equipment and materials had strong competitiveness. However, when calculating the regional share of all front-end devices, it was found that the share of Japanese devices has significantly decreased since 2010.

This situation will not change in the following year 2023.

Furthermore, by 2024, the situation will further deteriorate (Figure 10). In 2023, the market share of front-end devices by region was 41.8% in the United States, 29.3% in Europe, 21.1% in Japan, 1.7% in South Korea, and 0.6% in China. Japan ranked third and fell for the first time after being surpassed by Europe.

At this point, it is dangerous to rest assured because there is still a significant gap between Japan in third place, South Korea in fourth place, and China in fifth place. This is because it is difficult to collect accurate data on device sales in South Korea and China, so their sales share may be larger.

Especially in China, where equipment is mainly manufactured independently, I believe that the regional market share cannot be only 0.6%. Therefore, if Japan's market share continues to decline, it is likely to be lower than that of South Korea and China.

Reasons for the decline in the share of front-end equipment in Japan

So why has Japan's share of equipment decreased so much?

Figure 11 shows the results of the cause analysis. Looking at the market share of 13 devices in Japan in 2011, 10 years later in 2021, and in 2022 and 2023, we found that the market share of most devices is declining.

Among them, the market share of exposure equipment, dry etching equipment, CVD equipment, sputtering equipment, CMP equipment, batch cleaning equipment, visual inspection equipment, and length SEM has decreased the most significantly. Among them, exposure equipment, dry etching equipment, CVD equipment, and appearance inspection equipment are equipment groups with a market size of over 10 billion US dollars, so the decline in their market share is largely related to the overall decline in Japan. I can say that.

On the other hand, the market share of only one mask detection device in Japan has significantly increased. This is because Lasertec has made significant progress in the use of mask detection equipment in advanced exposure equipment EUV, surpassing the previously leading American company KLA. However, even if the market share of only one type of mask detection device increases significantly, it cannot compensate for the decline in market share of other devices.

Japan is currently planning to inject approximately 4 trillion yen in subsidies to semiconductor device manufacturers such as Rapidus and TSMC's Kumamoto factory. However, the chances of these policies achieving their initial goals are extremely low, and most of the subsidies mentioned above will be wasted.

On the contrary, immediate measures should be taken to prevent the decline in market share of various front-end devices. Now may be the last chance for Japan's front-end equipment industry... Even if I were to give lectures and write articles here, it would not be reflected in Japan's semiconductor policy at all.

In this situation, equipment manufacturers have no choice but to seek survival through self rescue.

Reference link https://eetimes.itmedia.co.jp/ee/articles/2407/10/news054_5.html

Disclaimer: This article is reproduced or adapted online, and the copyright belongs to the original author. The content of the article is the author's personal opinion. Reproduction is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.