Source: Woyan Capital

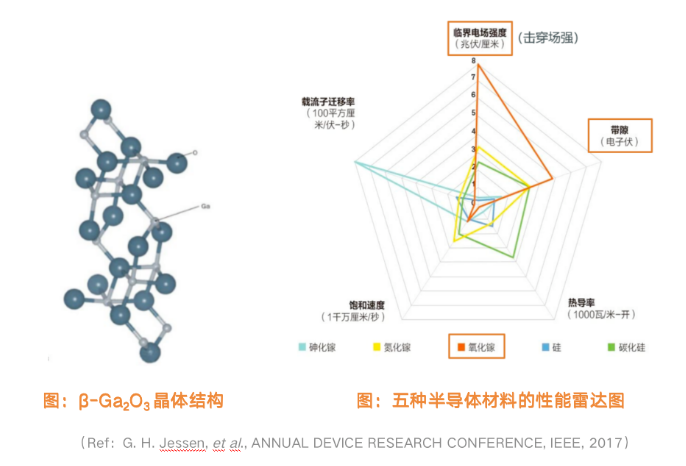

Recently, gallium oxide (Ga2O3) has received sustained attention as an "ultra wide bandgap semiconductor" material. Ultra wide bandgap semiconductors also belong to the "fourth generation semiconductors". Compared with third-generation semiconductors such as silicon carbide (SiC) and gallium nitride (GaN), the bandgap width of gallium oxide reaches 4.9 eV, higher than the 3.2 eV of silicon carbide and 3.39 eV of gallium nitride. A wider bandgap width means that electrons need more energy to transition from the valence band to the conduction band. Therefore, gallium oxide has characteristics such as high voltage resistance, high temperature resistance, high power, and radiation resistance. Moreover, under the same specifications, wide bandgap materials can be used to manufacture devices with smaller die sizes and higher power densities, saving supporting heat dissipation and wafer area, further reducing costs.

In August 2022, the Bureau of Industry Security (BIS) of the US Department of Commerce implemented export controls on the fourth generation semiconductor materials gallium oxide and diamond, stating that the high voltage resistance of gallium oxide is crucial to US national security in military applications. Since then, gallium oxide has attracted wider attention in global scientific research and industry.

Performance, Application, and Cost of Gallium Oxide

Fourth generation semiconductor materials

The first generation of semiconductors refers to elemental semiconductor materials such as silicon (Si) and germanium (Ge); The second generation of semiconductors refers to semiconductor materials with high mobility, such as gallium arsenide (GaAs) and indium phosphide (InP); Third generation semiconductors refer to wide bandgap semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN); The fourth generation of semiconductors refers to ultra wide bandgap semiconductor materials such as gallium oxide (Ga2O3), diamond (C), aluminum nitride (AlN), as well as ultra narrow bandgap semiconductor materials such as gallium antimonide (GaSb) and indium antimonide (InSb).

The fourth generation ultra wide bandgap materials overlap with the third generation semiconductor materials in terms of application, and have more prominent advantages in the field of power devices. The electrons of the fourth generation ultra narrow bandgap materials are easily excited to transition and have high mobility, mainly used in fields such as infrared detection and lasers. The fourth generation semiconductors are all on the "Strategic Electronic Materials" list of China's Ministry of Science and Technology, with many specifications being banned from export both domestically and internationally, making them a high ground for global semiconductor technology competition. The core difficulty of the fourth generation semiconductor lies in material preparation, and breakthroughs on the material side will gain great market value.

Note: Diamond and aluminum nitride substrates/epitaxial processes are difficult to enter the field of power devices due to issues such as high cost (gas-phase growth, several micrometers per hour, and only millimeter sized). (Ref:H. Sheoran, et al., ACS Appl. Electron. Mater., 4, 2589, 2022)

1.2 Crystal Structure and Properties of Gallium Oxide

Gallium oxide has five allotropes, namely α, β, γ, ε, and δ. Among them, β - Ga2O3 (β - phase gallium oxide) is the most stable, and when heated to a certain high temperature, all other metastable states transform into the β phase. At a melting point of 1800 ℃, it must be the β phase. At present, industrialization is mainly based on β - phase gallium oxide.

Properties of Gallium Oxide Material:

Ultra wide bandgap, stable performance in extreme environments such as ultra-high and low temperatures, strong radiation, and corresponding deep ultraviolet absorption spectra, has applications in solar blind ultraviolet detectors.

High breakdown field strength and high Baliga value, corresponding to high voltage resistance and low loss, make it an irreplaceable star material for high-voltage and high-power devices.

Note: Due to the fact that Japanese blind ultraviolet devices mainly use gallium oxide thin films, the gallium oxide referred to in this report specifically refers to single crystal substrates, and therefore mainly discusses the applications of gallium oxide in power devices, radio frequency devices, and other fields.

1.3 Gallium Oxide: Challenging Silicon Carbide

Gallium oxide is the only material in wide bandgap semiconductors that can be grown using liquid-phase melt method, and it has lower hardness. The cost of material growth and processing is superior to silicon carbide, and gallium oxide will comprehensively challenge silicon carbide.

1. Gallium oxide has good power performance and low loss

The Baliga values of gallium oxide are four times and ten times higher than those of GaN and SiC, respectively, indicating good conductivity. The power loss of gallium oxide devices is 1/7 of SiC, which is 1/49 of silicon-based devices.

2. Low processing cost of gallium oxide

Gallium oxide has a softer hardness than silicon, making it less difficult to process, while SiC has a higher hardness and extremely high processing cost.

3. Gallium oxide has good crystal quality

Gallium oxide is grown using a liquid-phase melt method, with dislocations (number of defects per square centimeter)<102 cm-2, while SiC is grown using a gas-phase method, with dislocation numbers of approximately 10 ^ 5 cm-2.

4. The growth rate of gallium oxide is 100 times that of SiC

Gallium oxide is grown by liquid-phase melt method, with a length of 10-30mm per hour and 2 days per furnace, while SiC is grown by gas-phase method, with a length of 0.1-0.3mm per hour and 7 days per furnace.

5. The production line cost of gallium oxide wafers is low and the production volume is fast

The wafer lines of gallium oxide are highly similar to those of Si, GaN, and SiC, with lower conversion costs, which is conducive to accelerating the industrialization progress of gallium oxide. According to the original report of Nihon Keizai Shimbun, "NovelCrystal Technology has successfully mass produced 100 mm wafers made of gallium oxide, a new generation of power semiconductor material, for the first time in the world. Customer enterprises can use existing equipment supporting 100 mm wafers to manufacture new generation products and effectively use old equipment invested in the past. ”Looking at it, gallium oxide does not require special equipment like SiC and requires the construction of new production lines. The potential convertible capacity is already enormous.

1.4 Application areas of gallium oxide: power devices

Four major opportunities for gallium oxide:

Single pole replacement of bipolar: MOSFET replaces IGBT. In the power markets of new energy vehicles, charging piles, ultra-high voltage, fast charging, industrial power supplies, motor control, etc., it is inevitable to eliminate silicon-based IGBT. Silicon based GaN, SiC, Ga2O3 are competitive materials.

More energy-efficient: Gallium oxide power devices have low energy consumption, which is in line with the strategy of carbon neutrality and peak carbon emissions.

Easy large-scale production: diameter expansion, simple production, easy implementation of chip technology, low cost.

High reliability requirements: stable materials, reliable structures, high-quality substrates/epitaxy.

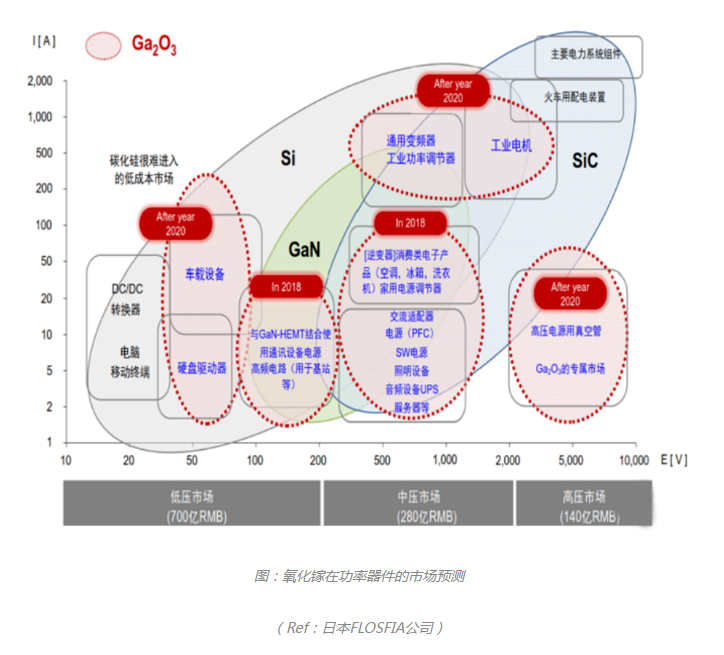

Target market for gallium oxide:

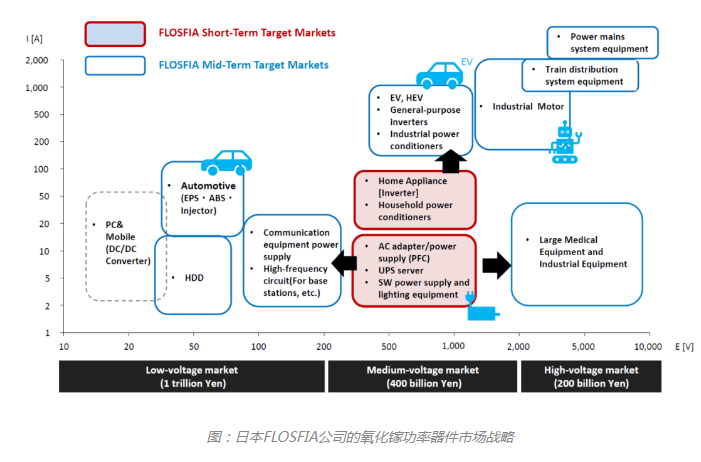

In the long run, gallium oxide power devices cover 650V/1200V/1700V/3300V, and are expected to fully penetrate the automotive and electrical equipment fields from 2025 to 2030. In the future, they will also play an advantage in the ultra-high voltage gallium oxide exclusive market, such as high-voltage power vacuum tubes and other application fields.

In the short term, it is expected that gallium oxide power devices will emerge first in the low threshold and cost sensitive medium and high voltage markets, such as consumer electronics, home appliances, and industrial power supplies that can leverage high material reliability and performance.

The market where gallium oxide is easy to win:

New energy vehicle OBC/inverter/charging station

DC/DC: 12V/5V → 48V conversion

The stock market of IGBT

1.5 Application areas of gallium oxide: RF devices

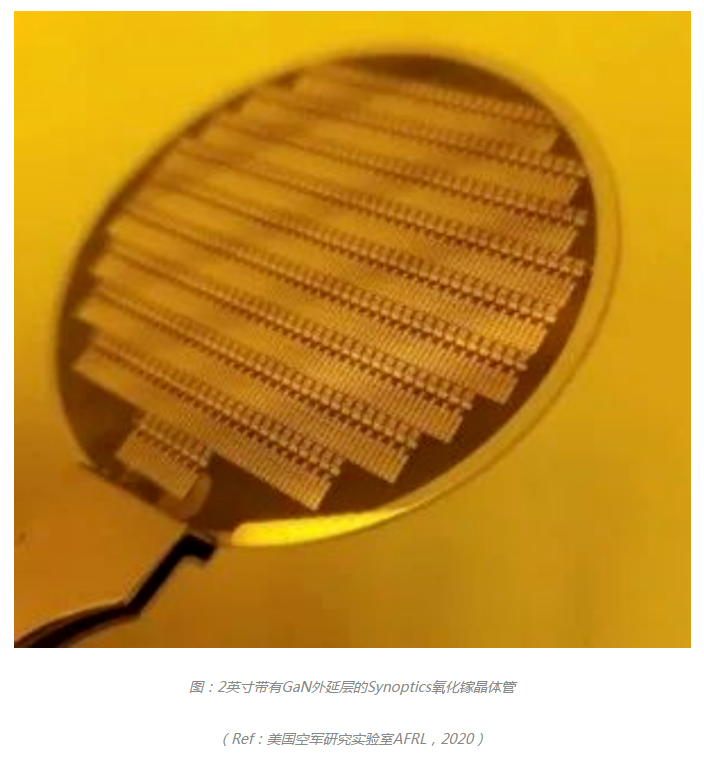

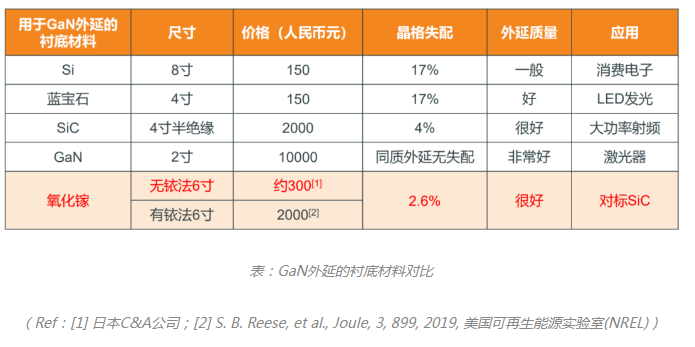

The GaN market requires large-sized and low-cost substrates to truly leverage the advantages of GaN materials.

The quality of epitaxial layers grown on homogeneous substrates is the best, but due to the high price of GaN substrates, relatively inexpensive substrates such as Si, sapphire, SiC substrates are used in LED, consumer electronics, RF and other fields. However, the differences in crystal structure between these substrates and GaN can cause lattice mismatch, which is equivalent to sacrificing epitaxial quality at cost. When GaN is homoepitaxial, it can be used in high demand applications such as lasers.

The lattice mismatch between GaN and gallium oxide is only 2.6%. GaN grown by heteroepitaxy on a gallium oxide substrate has high quality, and the cost of growing 6-inch gallium oxide by iridium free method is close to that of silicon. It is expected to have important applications in the GaN RF device market.

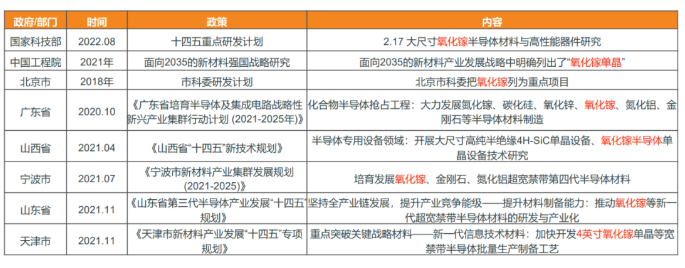

1.6 Gallium oxide industry related policies

Domestic support policies:

US embargo calls for localization:

On August 12, 2022, the Bureau of Industry and Security (BIS) of the US Department of Commerce implemented export controls on the fourth generation semiconductor materials gallium oxide (Ga2O3) and diamond, stating that their high voltage resistance properties are crucial to US national security for military applications.

Crystallization and Epitaxial Process of Gallium Oxide Substrate

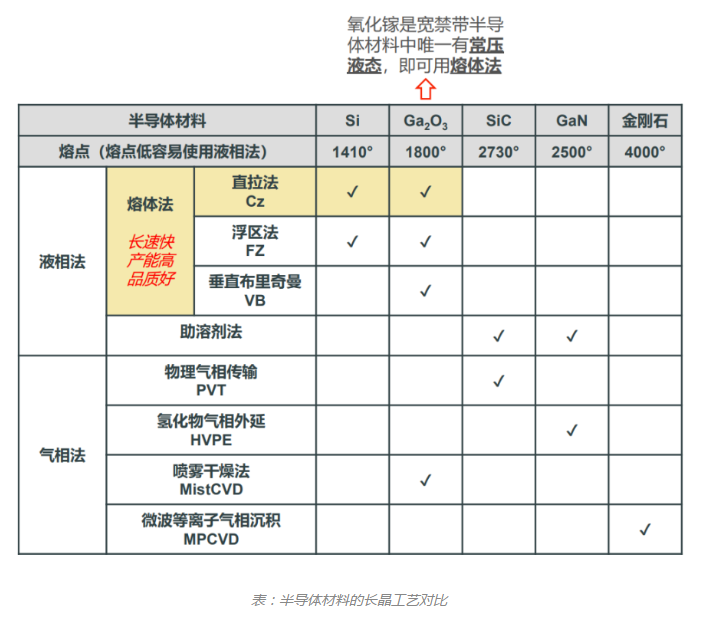

2.1 Crystallization process of semiconductor materials

The melt method is the most ideal way to grow semiconductor materials, with the following advantages.

Large size: Small seed crystals can grow into large crystals;

High output: Each furnace of ingots can cut thousands of substrates;

Good quality: dislocations can tend to zero, and the crystal quality is very good;

Fast growth rate: It can grow several centimeters per hour, much faster than the gas-phase method.

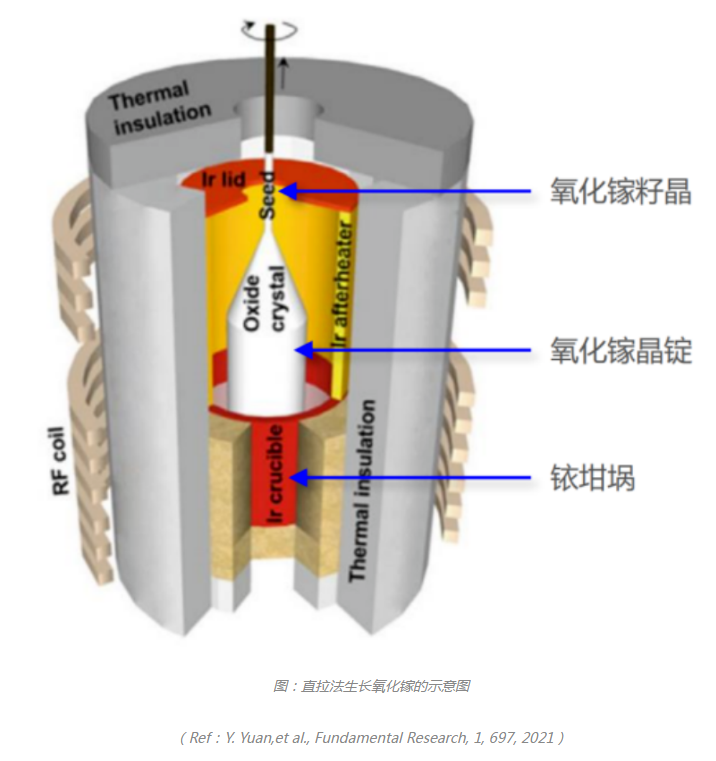

Gallium oxide is the only material in wide bandgap semiconductors that exists in a liquid state at atmospheric pressure and can be grown using the aforementioned melt method. The commonly used direct pull method for the growth of gallium oxide is a type of melt method, which relies on iridium crucibles (precious metal Ir elemental). The reason is that the direct pull method for the growth of gallium oxide requires a high-temperature and oxygen rich environment, otherwise the raw materials are easily decomposed into Ga and O2, affecting the products. Only precious metal iridium crucibles can maintain stability in such extreme environments.

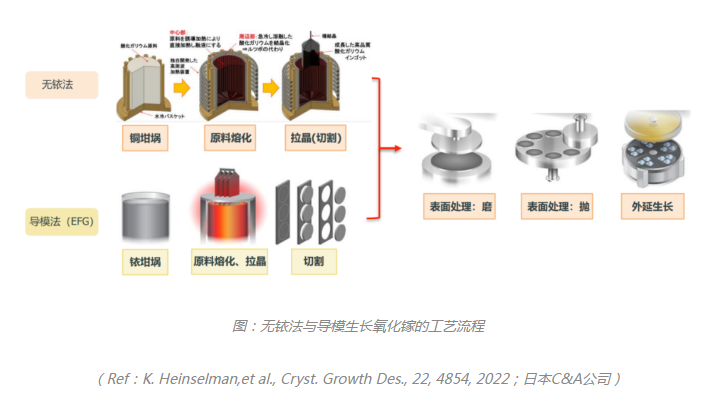

2.2 Gallium oxide crystal growth process

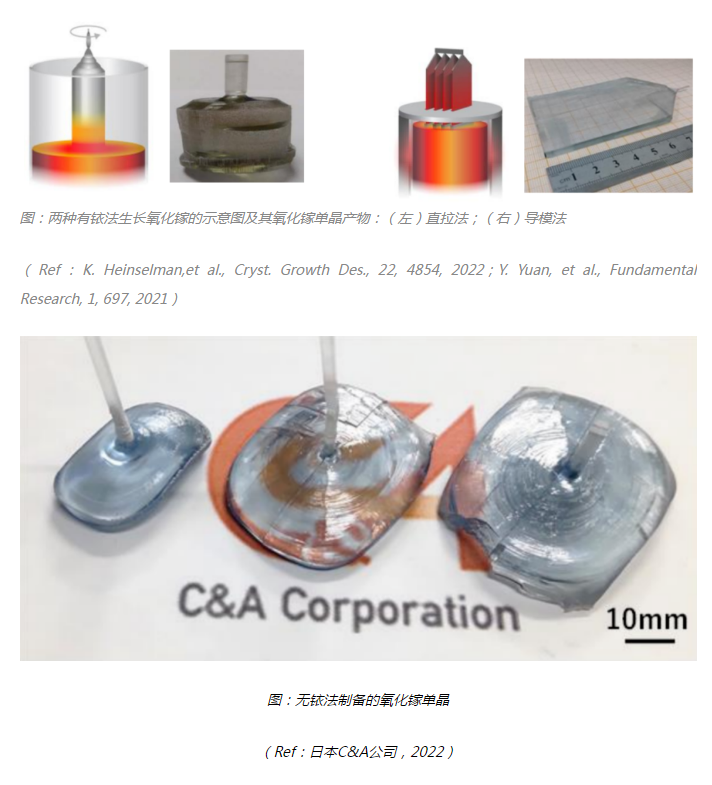

Due to the high volatility of raw materials in the direct drawing method, the crystal growth process of gallium oxide has gradually evolved from the direct drawing method to the guided mold method with iridium cover and mold. Both methods require the use of iridium crucibles, and the guided mold method has become the mainstream method for gallium oxide crystal growth.

However, due to the high cost and loss of iridium crucibles, they will be corroded and lost after growing for dozens of furnaces, requiring re melting and processing. In addition, during the crystal growth process, iridium will form impurities and enter the crystal. There is a strong demand in the industry for the development of iridium free methods.

In April 2022, Nihon Keizai Shimbun released a news that Japanese C&A Corporation used a copper crucible to grow a 2-inch GaO single crystal, which can reduce the cost to 1/100 of the guided mode method.

The process flow of gallium oxide growth begins with the melting and pulling of raw materials in a crucible, followed by cutting, grinding, and polishing to form a gallium oxide single crystal substrate. After further epitaxial processing, homogeneous epitaxial or heterogeneous epitaxial structures are obtained, and finally processed into gallium oxide wafers.

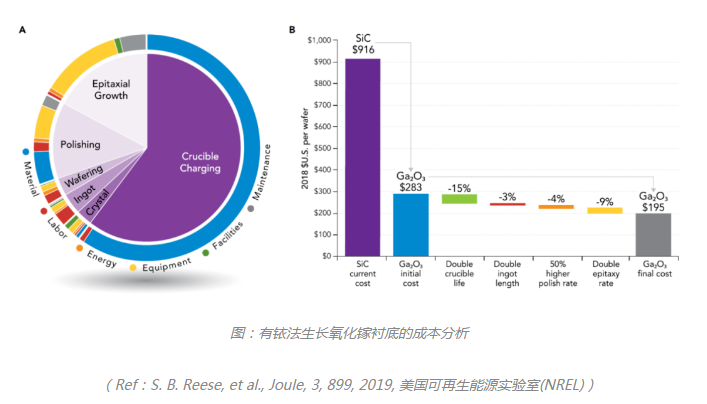

2.3 Cost comparison between iridium and iridium free materials

Iridium method: The National Renewable Energy Laboratory (NREL) in the United States predicts that without additional wafer manufacturing process optimization, the cost of 6-inch gallium oxide using iridium method is $283 (≈ 2000 RMB). After adopting various cost saving measures, it can be reduced to $195. Among them, iridium crucibles and their losses account for more than half.

Iridium free method: Japanese company C&A reported the results of the 2-inch iridium free method, claiming that the cost can be significantly reduced to 1/100 of the guided mold method.

2.4 Gallium oxide homoepitaxial growth

The rate of gallium oxide epitaxy is related to the crystal orientation of the substrate. Homogeneous epitaxy on the (100) plane is the most difficult, while (001) and (010) planes are easier. Therefore, in epitaxy and device processes, gallium oxide substrates on the (001) or (010) plane are generally chosen. The advantage of the melt growth method is the (010) radial surface, but currently the mainstream EFG guided mold method can only obtain narrow rectangular chips, and the (100) surface on the side is the easiest to obtain large sizes. In order to obtain valuable (001) and (010) surfaces, it is necessary to prepare thick crystals for oblique side cutting, which is difficult to achieve in the thick crystal process. Only Japan has reported crystals with a thickness exceeding 10mm, so currently only Japan can supply substrates with (001) and (010) surfaces.

In 2014, Tokyo A&M University in Japan obtained large-size epitaxial thin films on the (001) surface for the first time. At the same time, from 2012 to 2015, the size of β - Ga2O3 large wafers increased to 4 inches. The epitaxial process of gallium oxide promoted the development of devices and truly opened up the application of gallium oxide power devices. This requires substrate manufacturers of gallium oxide to provide products with multiple specifications of crystal planes.

At present, gallium oxide epitaxial processes include HVPE (halide vapor phase epitaxy) and MOCVD (metal organic chemical vapor deposition). HVPE equipment can deposit thick films, has fast film growth speed, and low equipment cost. However, related equipment has been banned abroad, and China's industry is calling for the ability to localize. NCT Corporation in Japan has implemented a 6-inch gallium oxide epitaxial process using HVPE.

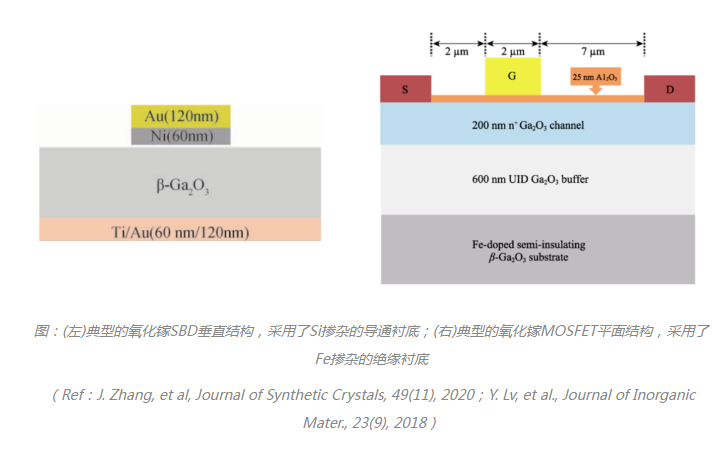

2.5 Doping of Gallium Oxide and Device Applications

Similar to SiC, gallium oxide also has conductive and semi insulating substrates, obtained by doping different elements, and has different applications in power devices.

Academic research and application development of gallium oxide

3.1 Gallium Oxide Substrate Competition

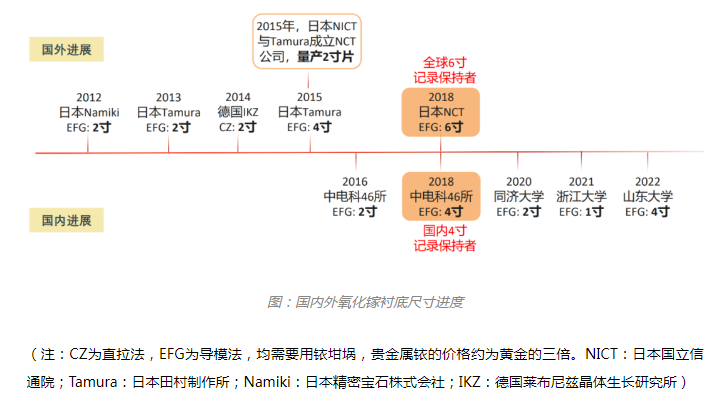

SiC took 20 years (1992-2012) to go from 2 inches to 6 inches, while gallium oxide took only 4 years (2014-2018) to go from 2 inches to 6 inches

Abroad: NCT Corporation of Japan leads the global gallium oxide industry, supplying nearly 100% of the world's gallium oxide substrates, with 2-inch wafers costing 25000 yuan and 4-inch wafers costing 50000 to 60000 yuan.

Domestically, the 46th Institute of China Electronics Technology Group set a domestic record for 4-inch gallium oxide in 2018, and Shandong University also reported 4-inch in 2022. Currently, there are no companies or universities in China with mass production capabilities, which to some extent limits the cost of iridium crucibles.

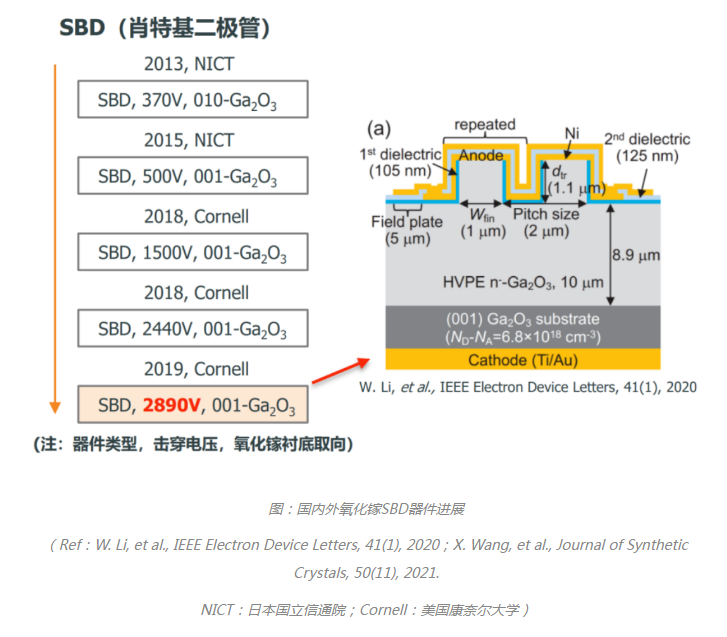

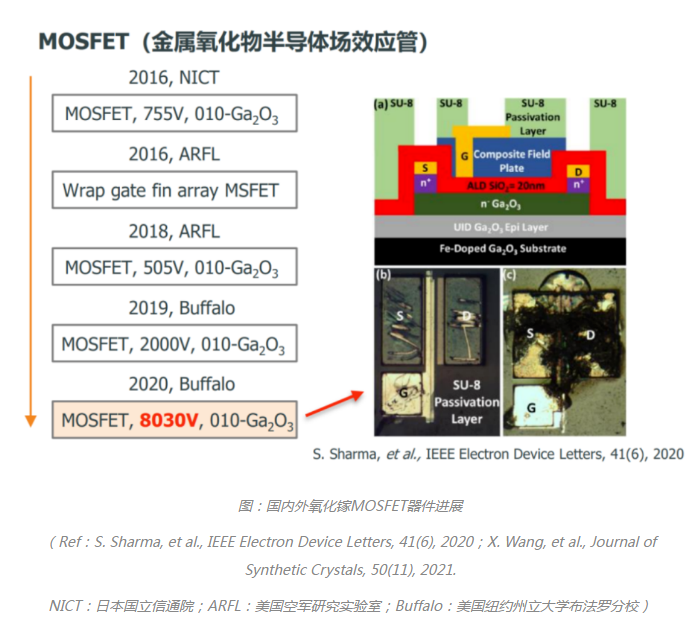

3.2 Gallium Oxide Device Competition

The United States has the most outstanding achievements in device research, and various innovative structures and processes have greatly promoted the progress of gallium oxide devices.

Japan: Thanks to the domestic supply of substrates and epitaxial wafers, the domestic gallium oxide industry chain was first formed in Japan.

China: With the advancement of substrates and epitaxy in our country, device related results have also reached international standards.

3.3 Research on the Disadvantages of Gallium Oxide Materials

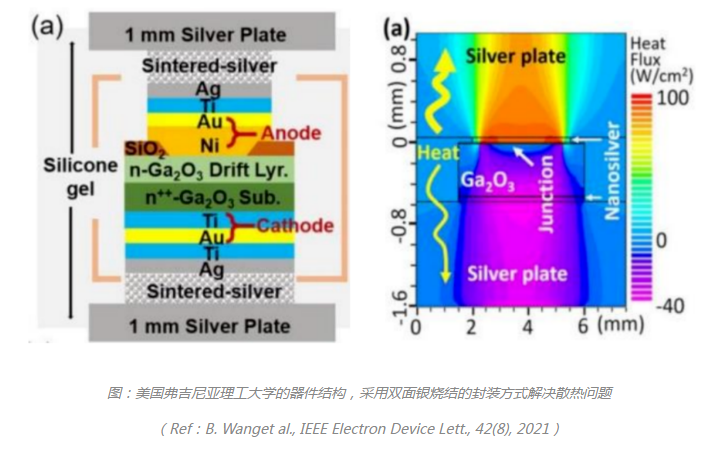

1. Addressing the issue of low thermal conductivity

Although gallium oxide poses thermal challenges, its heat dissipation is a problem that can be solved by engineering and does not constitute an obstacle to industrialization. As shown in the figure below, Virginia Tech University in the United States solves the heat dissipation problem by using a double-sided silver sintering packaging method, which can dissipate the heat generated at the Schottky junction. The thermal resistance at the junction is 0.5K/W, and at the bottom it is 1.43. It can withstand surge currents of up to 70A during transients.

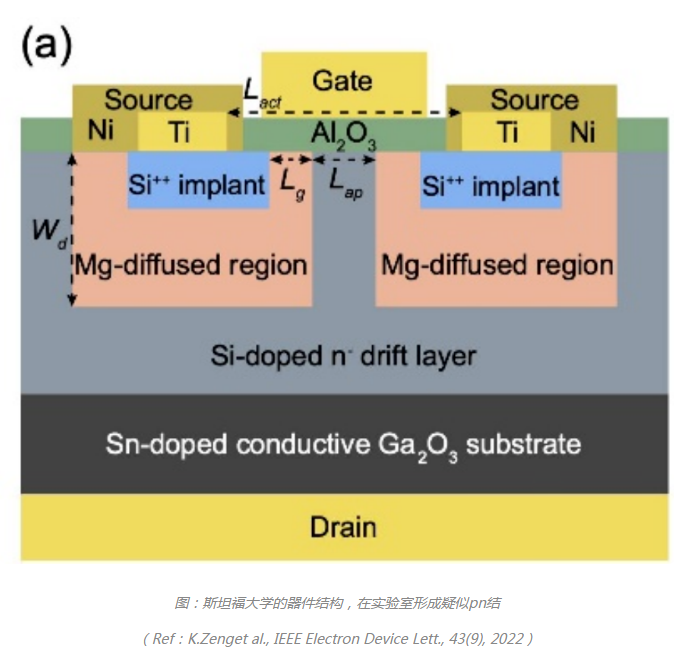

2. Resolve P-type doping

The valence band structure of gallium oxide cannot effectively conduct holes, making it difficult to manufacture P-type semiconductors. Recently, teams from Stanford, Fudan, and other institutions have implemented gallium oxide P-type devices in the laboratory, which are expected to gradually be introduced into industrial applications. As shown in the figure below, Stanford University published in August 2022 the results of realizing a P-type vertical structure of gallium oxide in the laboratory, forming a PN junction through Mg SOG magnesium diffusion, with a turn-on voltage of 7V and a switching speed of 109.

The industrial chain and market space of gallium oxide

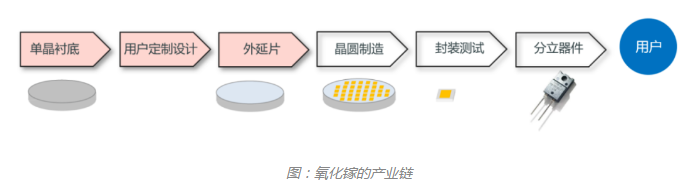

4.1 Gallium oxide industry chain

The gallium oxide substrate and epitaxial process are located upstream in the power device industry chain. Analogous to the silicon carbide industry chain, the value is concentrated in the upstream substrate and epitaxial links: 47% of the cost of one silicon carbide device comes from the substrate, 23% comes from epitaxial, and the substrate+epitaxial accounts for a total of 70%.

As the cost of gallium oxide further decreases, the substrate proportion will be much smaller than SiC.

4.2 Gallium oxide in the power device market

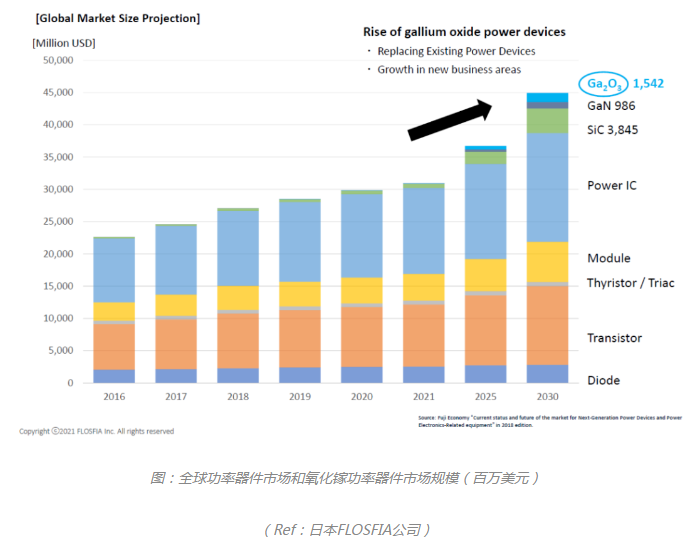

FLOSFIA, a well-known company in the field of gallium oxide in Japan, predicts that the market size of gallium oxide power devices will begin to surpass GaN by 2025, reaching $1.542 billion (approximately RMB 10 billion) by 2030, 40% of SiC, and 1.56 times that of GaN. (Note: FLOSFIA's predicted data is more conservative than Yole's prediction. Yole predicts a market capacity of 6.297 billion US dollars for silicon carbide power devices in 2027, while FLOSFIA predicts 3.845 billion US dollars in 2030.). )

In terms of the new energy vehicle market alone, global sales of new energy vehicles reached 6.5 million units in 2021, with a penetration rate of 14.8% and a penetration rate of 9% for silicon carbide. As the penetration rate of new energy vehicles increases, the market size will gradually expand. Currently, SiC and GaN are far from being able to dominate the market. In comparison, the development window for gallium oxide is very abundant.

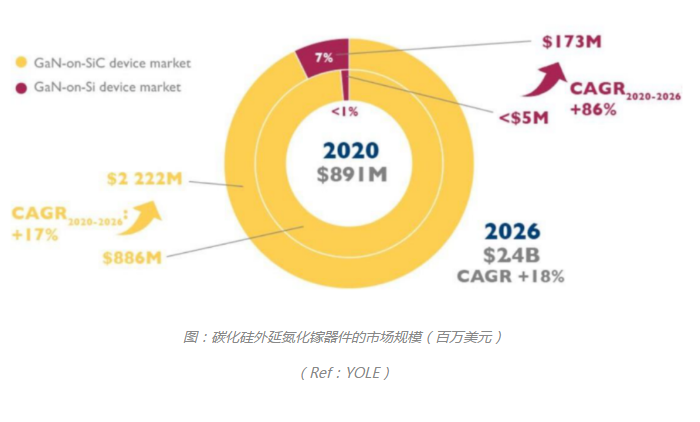

4.3 Gallium oxide in the RF device market

The market capacity of gallium oxide in RF devices can refer to the market of silicon carbide epitaxial gallium nitride devices. SiC semi insulating substrates are mainly used in 5G base stations, satellite communications, radar and other fields. In 2020, the market size of SiC epitaxial GaN RF devices was about 891 million US dollars, and it will grow to 2.222 billion US dollars (about 15 billion yuan) in 2026.

The competitive landscape and industrialization progress of gallium oxide

Japan: IDM leads the global industry chain

Internationally, only Japan has formed mass production and begun industrialization applications, mainly in industrial power supplies, industrial motor control, etc. The industry is mainly represented by Yaskawa Electric and Sato Electric. Japan is expected to mass produce gallium oxide power devices in 2023

NCT Company has already manufactured device samples on the Ga2O3 experimental line and is currently building a mass production line with plans for mass production in 2023.

FLOSFIA in Japan will achieve a monthly production capacity of hundreds of thousands of gallium oxide devices by Q2 2023, which will be sold to automotive component manufacturers and others.

Japanese electronic component manufacturer Tamura Manufacturing Co. will also start production at a scale of tens of thousands of units per month in 2024, and increase production capacity to about 60 million units per month by 2027.

The United States: The most advanced research on gallium oxide devices

Currently, only Kyma Corporation in the United States has 1-inch substrate products, lagging behind China in single crystal size and having a relatively blank industrial chain. The device achievements are outstanding, with strong innovation capabilities. Various innovative structures and processes have greatly promoted the progress of gallium oxide devices.

China: Chasing Japan in the Substrate Industry

Our country's gallium oxide substrates can be supplied in small quantities, and the industrialization process of epitaxial and device links is almost blank. The main force of research and development and outstanding achievements are all in universities and research institutes. However, the research and development of gallium oxide devices in China ranks among the top 3 in the world, and in terms of IP, it has reversed the passive situation in the SiC field. The current industrial stage of gallium oxide is similar to the state of SiC before the launch of Tesla Model 3, and the technical reserves have been completed, waiting for a landmark event to ignite the market.

Disclaimer: This article is reproduced or adapted online, and the copyright belongs to the original author. The content of the article is the author's personal opinion. Reproduction is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.