Source: Content from Omdia

abstract

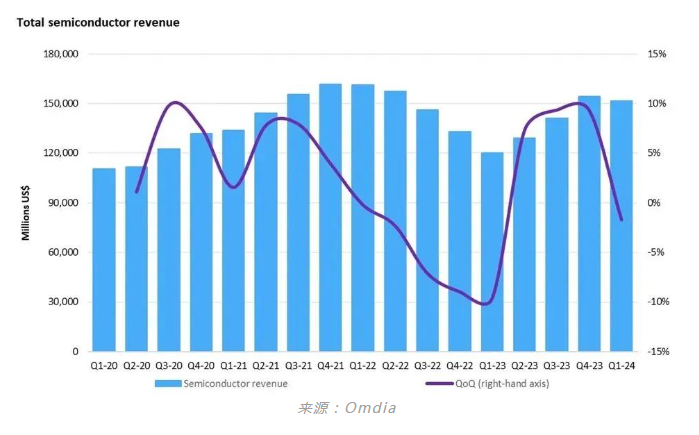

According to Omdia's latest Competitive Landscaping Tool for Semiconductors, the semiconductor market experienced a decline of approximately 2% to $151.5 billion in the first quarter of 2024. Normally, there is a decline in market revenue in the first quarter of each year, with a decrease of 4.4%, mainly due to the strong seasonal demand in the fourth quarter driving the market. However, in this quarter, most segmented markets within the semiconductor market are facing a downward trend. Consumer products have been hit the hardest, with a 10.4% decrease compared to the fourth quarter of 2023, while the industrial sector has decreased by 8.5% due to inventory adjustments. Even the automotive industry, which has been steadily growing in recent years, experienced a negative growth of 5.1% in the first quarter of 2024.

However, the decline in these segmented markets was offset by the growth of semiconductor related devices driven by strong demand in data centers, with the entire data center related semiconductor segment growing by 3.7%. The growth is mainly driven by high demand and high unit prices of related AI products represented by NVIDIA GPUs.

Nvidia maintained its strong growth momentum, increasing its market share by 2% and accounting for 14.5% of the entire semiconductor market revenue. And it has surpassed traditional semiconductor leaders Samsung and Intel (Samsung+Intel combined at 18.6%), and Nvidia's market share is still rising. In addition, with the recovery of memory growth, SK Hynix and Micron have risen in market share rankings.

The intelligent and electric transformation, as well as the integration of the supply chain brought about by the epidemic, triggered high growth in automotive semiconductors in previous years. However, due to the overall slowdown in growth trend, the automotive industry was ultimately unable to avoid decline. Starting from the third quarter of 2020, the automotive industry has achieved revenue growth for 13 consecutive quarters, but there was a slight decline of 0.6% in the fourth quarter of 2023. The decline in the first quarter of 2024 was even greater, with a decrease of 5.1% compared to the previous quarter. This downward trend reflects a widespread slowdown in demand for in car vehicles. In recent quarters, the growth rate of electric vehicles has slowed down, leading to a re adjustment of semiconductor demand. Despite these challenges, the automotive semiconductor market remains a promising area for long-term growth in the next five years.

According to Omdia's Global Semiconductor Manufacturing Market Tracking Report (GMMT) and Specialized Wafer Plant Tracking Report Q4 2023, the Integrated Plant Utilization Rate (IDM+Wafer Plant) reflects the overall trend of the semiconductor industry. At the beginning of the COVID-19 epidemic in 2022, the demand for semiconductors reached its peak, but in the second half of the year, this demand slowed down significantly. At the same time, the record high inventory level also had a significant impact on the market, leading to a sharp decline in its utilization rate. Although semiconductor revenue continues to grow in 2023, the utilization rate of manufacturing plants remains at a relatively low level of around 80%.

Craig Stice, Chief Analyst of Omdia Semiconductor Research, said, "In the second half of 2023, utilization rates began to slightly rebound and the market began to seek balance. However, demand in traditional application areas has not fully recovered, and it is expected that there will be a significant gradual improvement in demand in the second half of 2024. This should lead to inventory adjustments, which will once again drive up factory utilization rates

Disclaimer: This article is reproduced or adapted online, and the copyright belongs to the original author. The content of the article is the author's personal opinion. Reproduction is only intended to convey a different viewpoint and does not represent the company's endorsement or support of that viewpoint. If you have any objections, please feel free to contact us.